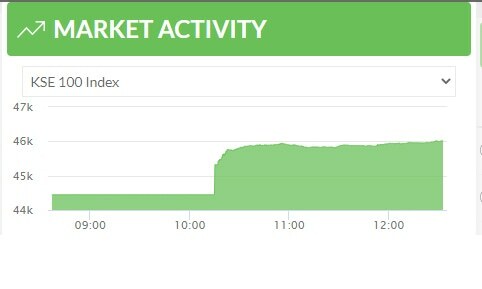

KARACHI: The stock market opened in the positive zone on Monday and remained green throughout the day in anticipation of the resumption of the International Monetary Fund (IMF) loan programme in June, according to Arif Habib Ltd.

Positive sentiments also helped the rupee get stronger against the dollar. The local currency appreciated 0.35 per cent against the dollar to close the day at 199.06.

Activity on the main board remained healthy, especially in the energy exploration and production sector. Oil and Gas Development Company Ltd remained in the limelight on the expectation of a nod from the Economic Coordination Committee of the cabinet on the conversion of the company’s receivables from state-owned Power Holding Private Ltd into Pakistan Investment Bonds.

As a result, the KSE-100 index settled at 43,040.14 points, up 178.69 points or 0.42pc from a day ago.

The trading volume decreased 64.5pc to 187.5 million shares while the traded value went down 56.2pc to $30.7m on a day-on-day basis.

Stocks contributing significantly to the traded volume included TPL Properties Ltd (18.53m shares), Pakistan Refinery Ltd (17.23m shares), Cnergyico PK Ltd (9.97m shares), Ghani Global Holdings Ltd (8.7m shares) and Oil and Gas Development Company Ltd (8.48m shares).

Sectors that contributed the highest number of points to the benchmark index included oil and gas exploration (79.38 points), oil and gas marketing (24.74 points), technology and communication (23.16 points), automobile assembling (20.12 points) and commercial banking (13.53 points).

Shares contributing most positively to the index included Oil and Gas Development Company Ltd (48.52 points), Millat Tractors Ltd (33.04 points), Pakistan Petroleum Ltd (22.49 points), Systems Ltd (22.05 points) and Pakistan Oilfields Ltd (21.97 points).

Stocks that contributed most negatively to the index included Mari Petroleum Company Ltd (13.6 points), Engro Polymer and Chemical Ltd (13.2 points), Indus Motor Company Ltd (9.59 points), Dawood Hercules Corporation Ltd (7.71 points) and Bank AL Habib Ltd (6.18 points).

Foreign investors were net sellers as they offloaded shares worth $0.7m.

Published in Dawn, May 31st, 2022

Dear visitor, the comments section is undergoing an overhaul and will return soon.