KARACHI: Shares trading began on a bullish note on Tuesday before profit-taking shaved off the early gains in later hours.

According to Ahsan Mehanti of Arif Habib Corporation, the index closed at a relatively higher level from a day ago because of a few selected stocks that rallied on pre-budget speculations.

The rebalancing of MSCI also took effect with Oil and Gas Development Company Ltd becoming part of the MSCI Frontier Standard Index and Habib Bank Ltd getting moved from the same to the MSCI Frontier Small Cap Index. In addition, Engro Polymer and Chemical Ltd and Indus Motor Company were included to the MSCI Frontier Small Cap Index, according to Topline Securities.

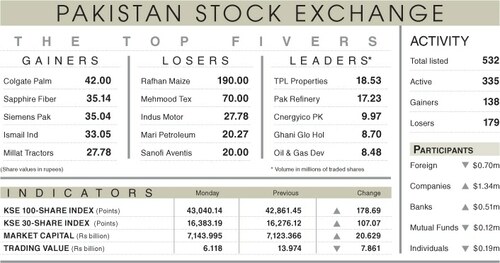

As a result, the KSE-100 index settled at 43,078.14 points, up 38 points or 0.09 per cent from a day ago.

The trading volume increased 52.2pc to 285.3 million shares while the traded value went up 20.7pc to Rs7.38 billion on a day-on-day basis.

Stocks contributing significantly to the traded volume included Silkbank Ltd (71.62m shares), Pakistan International Bulk Terminal Ltd (35.61m shares), Pakistan Refinery Ltd (21.11m shares), Pak Elektron Ltd (17.83m shares) and WorldCall Telecom Ltd (10.58m shares).

Sectors that contributed the highest number of points to the benchmark index included power generation and distribution (64.16 points), oil and gas exploration (56.84 points), technology and communication (21.7 points), automobile assembling (20.09 points) and fertiliser (16.43 points).

Shares contributing most positively to the index included the Hub Power Company Ltd (67.28 points), Millat Tractors Ltd (28.31 points), Systems Ltd (26.38 points), Pakistan Oilfields Ltd (25.37 points) and Oil and Gas Development Company Ltd (17.36 points).

Stocks that contributed most negatively to the index included Lucky Cement Ltd (46.68 points), MCB Bank Ltd (18.88 points), Habib Metropolitan Bank Ltd (9.61 points), the Searle Company Ltd (9.32 points) and Engro Fertilisers Ltd (8.76 points).

Foreign investors were net buyers as they purchased shares worth $2.5m.

Published in Dawn, June 1st, 2022

Dear visitor, the comments section is undergoing an overhaul and will return soon.