KARACHI: The stock market continued its selling momentum on Thursday from the preceding session on the back of rising yields on government papers, said Arif Habib Ltd.

The yield on the three-month treasury bills went up by 75 basis points to 15.25 per cent in the latest auction. This has led to investors’ concerns about a hike in the benchmark interest rate set by the monetary policy committee of the central bank.

The trading volume remained dull, although third-tier stocks were in the limelight, it added.

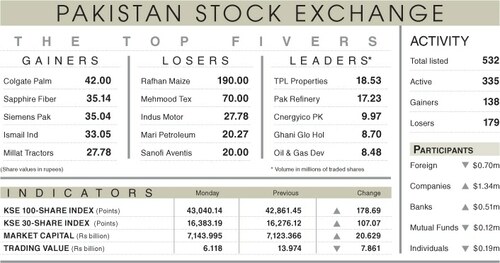

As a result, the KSE-100 index settled at 42,237.91 points, down 518.13 points or 1.21pc from a day ago.

The trading volume decreased 19.2pc to 157 million shares while the traded value went down 1.2pc to $26.8m on a day-on-day basis.

Stocks contributing significantly to the traded volume included Pakistan Refinery Ltd (14.9m shares), Unity Foods Ltd (10.9m shares), Cnergyico PK Ltd (9.8m shares), Silkbank Ltd (9.1m shares) and WorldCall Telecom Ltd (7m shares).

Sectors that took away the highest number of points from the benchmark index included commercial banking (105.85 points), fertiliser (66.79 points), cement (62.23 points), technology and communication (48.74 points) and chemical (45.74 points).

Shares contributing most negatively to the index included Habib Bank Ltd (43.9 points), Lucky Cement Ltd (34.73 points), Oil and Gas Development Company Ltd (28.07 points), United Bank Ltd (25.74 points) and Thal Ltd (24.52 points).

Stocks that contributed most positively to the index included Mari Petroleum Company Ltd (13.48 points), Standard Chartered Pakistan Ltd (6.38 points), National Bank of Pakistan Ltd (3.2 points), Abbott Laboratories Pakistan Ltd (2.11 points) and Attock Refinery Ltd (1.77 points).

Stocks that registered the largest declines in percentage terms were Thal Ltd (7.5pc), Colgate-Palmolive Pakistan Ltd (4.52pc), Avanceon Ltd (4.28pc), International Industries Ltd (4.15pc) and Bannu Woollen Mills Ltd (4.12pc).

Foreign sellers were net sellers as they offloaded shares worth $1.81m.

Published in Dawn, June 3rd, 2022

Dear visitor, the comments section is undergoing an overhaul and will return soon.