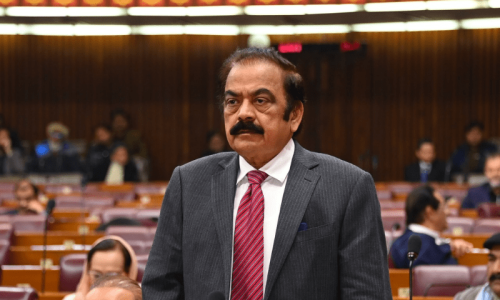

Finance Minister Miftah Ismail unveiled the Pakistan Economic Survey (PES) 2021-22 on Thursday, which revealed a growth rate of 5.97 per cent against a target of 4.8pc.

However, the country's growth story — having rebounded from the pandemic (when the economy contracted in FY20) to posting growth of 5.74pc last year and maintaining a V-shaped recovery by posting GDP growth of 5.97pc this year — was dampened in the face of glaring macroeconomic imbalances, suggesting that this growth is unsustainable.

The balance of payments situation of the country particularly stood out with trade deficit jumping more than 50pc over the same period last year and the current account deficit spiralling out of control as well.

The economic survey is an annual report on the performance of the economy, focusing in particular on major macroeconomic indicators. Interestingly, this time — perhaps a first — a new government (PML-N-led coalition) is presenting the economic performance of a previous government (PTI).

Growth

The finance minister, while unveiling the survey, said "achieving growth was not an issue for Pakistan, the real issue is achieving sustainable growth".

"This year GDP growth is 5.97pc growth ... but as usual the current account deficit has once again shown that we have a balance of payments issue," Ismail said.

This overall growth came on the back of 4.40pc growth in Agriculture, 7.19pc growth in Industries, and 6.19pc growth in Services — meaning that all three major sectors surpassed their targets of 3.5pc, 6.5pc and4.7pc, respectively.

Even though the country surpassed overall growth expectations as well as sector-wise growth targets, "underlying macroeconomic imbalances and associated domestic and international risks have dampened celebrations", according to the survey document.

Trade deficit

According to the survey document, imports for the July-March period came in at $58.9bn, growing 49.1pc from the year-ago period. The finance minister this would go up to $77 billion by the end of the fiscal year and end up being the "highest-ever import bill in terms of GDP".

On the other hand, during Jul-Mar FY2022, goods exports grew by 26.6pc and amounted to $23.7bn, whereas services exports grew by 17.1pc and amounted to $5.1bn, according to the survey.

"Despite the encouraging export performance, the country’s imports have also risen significantly. The broad-based surge in global commodity prices, Covid-19 vaccine imports, and demand-side pressures, all contributed to the rising imports," the PES said.

Resultantly, compared to the year-ago period, trade deficit grew by 55.5pc in the Jul-Mar FY22 period and amounted to $32.9 billion or 8.6pc of the GDP, which is "historically high", according to the survey document.

Current account

Despite export receipts and workers’ remittances — which came in at $26.1bn to record a growth of 7.6pc from the year-ago period — both reaching record-high levels during the nine-month period, import payments registered a "sizable, broad-based increase".

As a result, the current account deficit widened considerably over last year, the document revealed.

"These payment pressures manifested on the interbank PKR-USD exchange rate, which depreciated 14.1pc during Jul-Mar FY2022. The SBP’s foreign exchange reserves also came under pressure from Q2 onwards, dropping $5.9bn during the first nine months of the fiscal year to $11.4bn by end March 2022."

Therefore, during this period, the current account posted a deficit of $13.8bn, or 3.6pc of GDP, against a deficit of $0.5bn last year. The major contributor to the higher current account deficit was the 55.5pc increase in the merchandise trade deficit during Jul-Mar FY2022, the survey document revealed.

"The widening of the current account deficit together with a build-up in inflationary pressures in the backdrop of the geopolitical situation (especially the Russia-Ukraine conflict) has created significant challenges for sustainable economic growth.

"In addition, the recent emergence of domestic conditions (including political instability) is eroding business confidence. Thus, all in all, inflationary and external sector pressures have created macroeconomic imbalances in the economy," the PES added.

Inflation

Inflation from July to April of the outgoing fiscal year was measured at 11pc, compared to the target of 8pc.

The PES cited an abnormal increase in global commodity prices, especially crude oil and edible oil, as the reason for the rise in domestic prices.

"The group-wise breakdown indicates that major contributors to headline inflation are transport, followed by furnishing & household equipment maintenance and housing, water, electricity and gas."

Non-perishable food items are the main contributory factor in jacking up food inflation, it further noted.

FBR tax collection

The survey noted that FBR initiated various policy and administrative measures to facilitate the taxpayers to mobilise domestic resources and generate sufficient revenue without hurting growth momentum in the outgoing year. As a result, FBR tax collection witnessed a substantial growth of 28.5pc during July-April FY2022.

The amount collected during this period stood at Rs4,855.8bn compared to Rs3,777.7bn last year.

However, tax relief measures have impacted revenue collection by approximately Rs73bn during the month of April, the PES stated.

Fiscal deficit

Despite the significant rise in tax collection, higher current and development expenditures widened the fiscal deficit during the July to March FY22 period to 3.8pc of the GDP compared to 3pc during the same time last year, according to the survey.

"Due to additional spending under Covid-19 funds for vaccine procurement, IPPs circular debt payment, social sector spending, and higher development expenditures, the fiscal sector remained under tremendous pressure. All these factors, along with the global economic challenges posed by the Russia-Ukraine conflict, as well as the impact on international commodities and oil prices, have increased the risk of fiscal slippages during the current fiscal year."

It noted that the government had initially frozen oil prices to provide relief but due to the rising fuel and energy rates in the international market, "providing relief acted as a double-edged sword, potentially increasing the fiscal deficit, and reducing fiscal space".

Interesting nuggets from the PES

- The performance of large-scale manufacturing stood tremendous with 10.4pc growth during July-March FY2022 as compared to growth of 4.2pc same period last year.

- The total electricity generation capacity during July-April 2022 has increased by 11.5pc and reached 41,557MW from 37261MW during the same period last fiscal year.

- Import bill of oil increased by 95.9pc to $17.03 billion during July-April FY2022 compared to $8.69 billion during the same period last year.

- IT exports during (July-March FY2022) surged to $1.948 billion at a growth rate of 29.26pc in comparison to $1.5 billion during July-March FY2021.