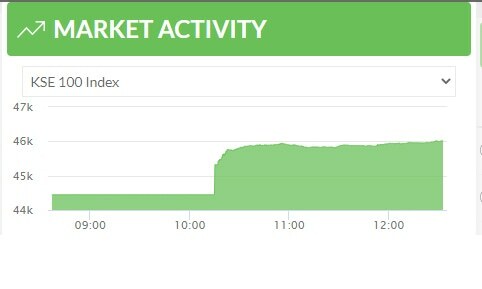

The Pakistan Stock Exchange's (PSX) benchmark KSE-100 index staged a rally of 748.97 points, up 1.79 per cent, on Tuesday as investor sentiment was buoyed by the possibility of an announcement revealing Pakistan's deal with the International Monetary Fund (IMF) for the release of $1 billion loan tranche.

Raza Jaffrey, head of research at Intermarket Securities, said that there was "rising exuberance" in the market over reports that a staff-level agreement with the Fund was imminent.

"If this happens, it can unlock funding from other sources, lift foreign exchange reserves and help the rupee recover some ground. The stock market appears to be anticipating this chain of events," he told Dawn.com.

Ahsan Mehanti of the Arif Habib Corporation said stocks showed "sharp recovery" on the finance minister hinting at the resumption of the IMF bailout programme within a day or two.

On Monday, Finance Minister Miftah Ismail had expressed hope that an agreement with the IMF for the revival of the Extended Fund Facility (EFF) would be reached "within one or two days".

Reporters had also asked him whether the Fund was opposed to the government's decision to increase the salaries of employees by 15pc and tax exemption for those earning less than Rs1.2 million annually.

"The IMF has nothing to do with salaries as long as we have the money," he had said, adding that the government will "protect" those earning less than Rs1.2m annually.

Pakistan signed a 39-month, $6 billion EFF in July 2019, but the Fund stopped the disbursement of about $3bn when the previous government reneged on its commitments. Currently, Islamabad wants the IMF to not only resume disbursements, but to also expand the size and duration of the programme.

So far, Pakistan and the IMF have not yet been able to reach close to a staff-level agreement for revival of the loan programme, leaving authorities in a tight spot to bridge the gap and get the updated federal budget for the fiscal year 2022-23 passed by the National Assembly.

The authorities in the finance ministry were expecting to conclude the staff-level agreement by Sunday (June 19) on the basis of revenue and expenditure measures that could deliver next year’s primary budget (the difference between revenues and expenditures, excluding interest payment) in Rs152bn surplus.

However, the IMF staff still has reservations over Rs9.5 trillion expenditures projected by the authorities for the next fiscal year. The revenue measures in the budget, according to IMF estimates, are also insufficient to deliver slightly over Rs7tr target.