Environmental sustainability is not an active part of the narrative for emerging markets. In developing countries where human rights atrocities are swept under the rug, taking care of the environment is not high up the totem pole.

While in Pakistan, all trees are good trees, palm oil plantations have been accused of deforestation which endangers habitats of flora, fauna and animals. The charge of pollution has also been laid at its door since palm oil diesel releases up to three times as many emissions compared to traditional petroleum-based fuel.

The EU is a major importer of palm oil, and as a bloc made of developed nations, cares about sustainability a whole lot. Since it is making efforts to source fuel sustainably, palm oil by-products are not acceptable, a case that is being duelled out in the World Trade Organisation.

Though Indonesia is the biggest palm oil exporter, the forces behind it are Malaysian and Singaporean private investors with connections with Indonesian authorities. According to one estimate, Malaysian and Singaporean investors control two-thirds of Indonesia’s crude oil production.

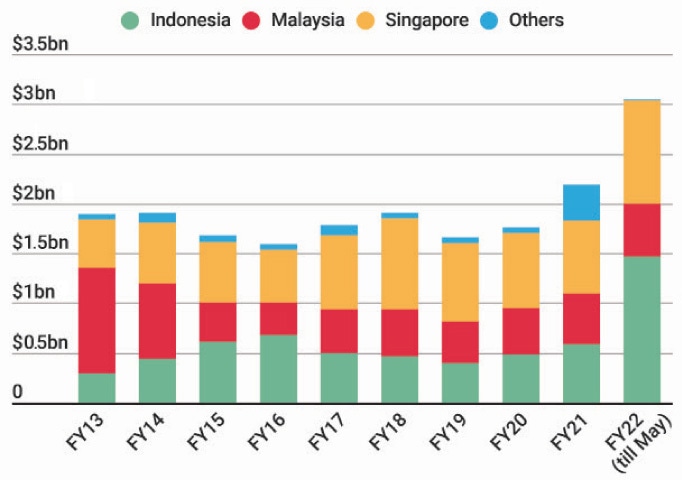

While palm trees are grown in Malaysia and Indonesia, Singapore’s financial institutions are among the biggest lenders and investors in the palm oil industry. Singapore is also home to numerous palm oil companies including some of the largest in the world, making it a centre for oil refining globally. This is represented in Pakistan’s FY22 palm oil imports of which 48pc stem from Indonesia, 17pc from Malaysia and 34pc from Singapore.

Simple demand and supply dynamics indicate that if the EU imports less palm oil, its price will spiral down. Given the current $3bn plus bill, it is good news for Pakistan regardless of which country it imports from.

Published in Dawn, The Business and Finance Weekly, July 25th, 2022

Dear visitor, the comments section is undergoing an overhaul and will return soon.