Shares at the Pakistan Stock Exchange opened the week in the red, with investor sentiment sliding as the State Bank of Pakistan (SBP) is expected to tighten policy rate later in the day.

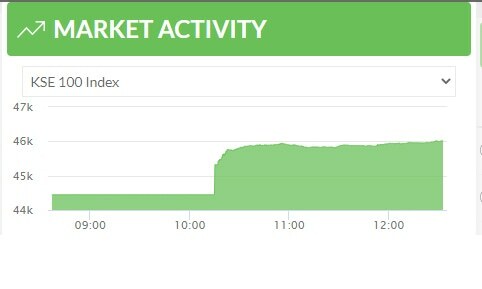

The benchmark KSE-100 index closed down 443 points, or 1.03 per cent.

Raza Jafri, head of research at Intermarket Securities, said the rise in political temperature over the weekend had also weighed down market sentiment.

A terrorism case was registered against PTI Chairman Imran Khan for a speech he delivered on Saturday while rumours of the government’s plan to arrest him had been making rounds since yesterday.

“Investors are also cautious ahead of the monetary policy, set for later today. Valuations remain cheap but wait-and-see is prevailing particularly as the KSE-100 has already recovered sharply in the first two weeks of August.”

First National Equities Limited Director Amir Shehzad was also of the view that the political uncertainty in light of rumours regarding Imran Khan’s possible arrest and the monetary policy statement expected today were the main drivers of today’s bearish activity.

Shehzad said it was expected that the policy rate would be increased by 75 basis points later in the day.

“However, if we see an increase of below 50 bps, there could be a 1500 to 2000 points rally. On the other hand, if the rate is increased by 100bps or more, the market could react negatively,” he said.

Ahsan Mehanti, director of Arif Habib Corporation, said stocks were witnessing bearish activity on speculations ahead of the central bank’s policy statement today amid high inflation data.

Headline inflation rose sharply to 24.9pc year-on-year in July from 21.3pc in June.

“Investor fears over negative outcome of fresh revenue measures and new taxes under IMF program ahead of the release of the next loan tranche is also playing a catalyst’s role in bearish activity,” he said.