• Qatar Investment Authority may invest in various key sectors; evaluating strategic partnerships in airport management, running of Roosevelt Hotel

• Analysts say pledged capital sketchy for now; $2bn may be in form of safe deposits, quantum of investment likely to be over $1bn

KARACHI: The state-owned investment fund of Qatar is going to invest $3 billion in Pakistan, an official statement from the office of the energy-rich country’s ruler said on Wednesday.

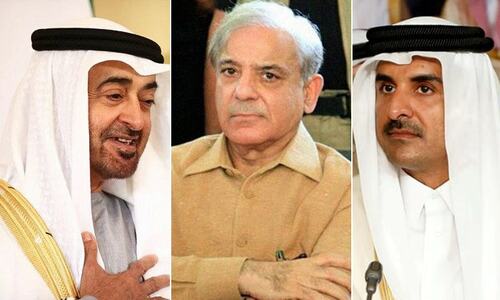

The Emiri Diwan, the administrative office of the emir, released the statement as Prime Minister Shehbaz Sharif held official talks with Qatari Emir Sheikh Tamim bin Hamad al-Thani in Doha following a meeting with the sovereign fund officials a day ago.

The $450bn Qatar Investment Authority announced its “aspiration to invest $3bn in various commercial and investment sectors in the Islamic Republic of Pakistan”, it said.

The investment from the Gulf nation is expected to help Pakistan bridge the widening gap between the inflows and outflows of dollars that’s resulting in a persistent balance-of-payments crisis. The dollar shortage has weakened the local currency and caused a drawdown on the central bank-held foreign exchange reserves, which dropped to $7.9bn at the last count.

Speaking to Dawn, Arif Habib Ltd Head of Research Tahir Abbas said the information about the nature of the pledged investment is sketchy at the moment. “I think $2bn will be in the form of safe deposits with the central bank while $1bn will constitute the investment part,” he said.

Earlier this week, State Bank of Pakistan (SBP) Acting Governor Murtaza Syed told analysts in a post-monetary policy briefing that the country would receive $2bn from Qatar in the next 12 months. Although the Qatari statement didn’t mention if the pledged investment was in addition to $2bn indicated by the SBP’s acting chief, analysts believe the two amounts will likely overlap.

International news agency Bloomberg reported Qatar is evaluating strategic investments in Islamabad and Karachi airports in addition to stakes in renewable energy, power and hospitality sectors.

Wire service Reuters said Doha has shown interest in airport management partnership and the Roosevelt Hotel in New York’s Manhattan, which is owned by Pakistan International Airlines (PIA). It quoted officials as saying that Pakistan has offered a 25pc stake in the hotel, which shut down in 2020 because of a coronavirus-related slump in international travel.

However, Mr Abbas said any substantial progress in the matter of investments in PIA and its hotel is unlikely given the mounting political challenges the government faces on the domestic front.

“We were expecting some update on LNG, but there’s been no word on that so far. We get eight cargoes from Qatar every month. We’re looking for two to three additional cargoes on the long-term basis,” he said.

Qatar is a major supplier of LNG to Pakistan on a long-term contract basis. It’s also sponsoring one of the two upcoming LNG terminals in Karachi.

Topline Securities Associate Director of Research Umair Naseer told Dawn it’ll be futile to expect Qatar to provide Pakistan with additional LNG cargoes on a long-term basis.

“Supplies are already constrained. Europe is desperate for energy as the winter is approaching. Even if Qatar offered to sell us LNG on a long-term basis, it’d make little sense for Pakistan to sign up for long-term supplies given the prevailing high prices,” he said.

Meanwhile, a statement from the prime minister’s office on Wednesday said Mr Sharif and Qatar’s emir agreed to increase the bilateral trade, deepen collaboration in agriculture and food sectors and boost cooperation in energy, renewable energy, tourism and hospitality segments. They also agreed to expand cooperation in defence, aviation and maritime sectors.

Recalling Pakistan’s long-term partnership with Qatar in the LNG sector, the prime minister thanked the emir for his support in meeting Pakistan’s energy needs. The two sides also explored new avenues for mutually beneficial cooperation in the energy sector.

Sheikh Tamim reassured Mr Sharif of Qatar’s commitment to forging a stronger economic partnership with Pakistan. The premier thanked the emir for Qatar Investment Authority’s readiness to invest $3bn in various commercial and investment sectors in Pakistan.

Mr Sharif’s visit to Qatar comes ahead of an International Monetary Fund meeting next week that is expected to approve more than $1bn in financing that has been stalled since the beginning of the year. Saudi Arabia and the UAE have also indicated to provide $1bn each in oil purchase financing.

The prime minister on Tuesday invited the Qatar Investment Authority to invest in Pakistan’s energy and aviation sectors. He previously mentioned renewable energy, food security, industrial and infrastructure development, tourism and hospitality among sectors of interest.

Published in Dawn, August 25th, 2022