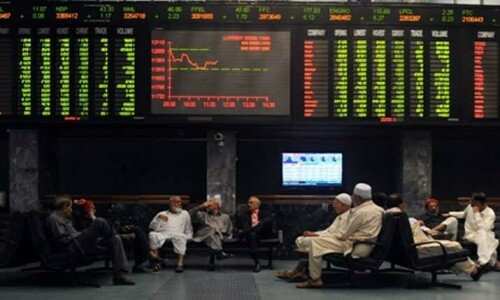

KARACHI: The stock market opened on a depressing note on Wednesday owing to rising political infighting.

According to Arif Habib Ltd, the benchmark index witnessed a range-bound session because investors remained on the sidelines while waiting for clarity on the political front.

However, value buying took place in the cement sector during the last trading hour, which helped the index close in the green zone.

The rupee extended its overnight gains against the dollar and appreciated 0.63pc on a day-on-day basis to close at 218.75. The approval of the loan tranche worth $1.17 billion by the Executive Board of the International Monetary Fund (IMF) seems to have arrested the steep fall in the local currency.

The rupee has shed 19.31pc against the greenback since the beginning of 2022.

As a result, the KSE-100 index settled at 42,351.15 points, up 155.89 points or 0.37 per cent from its last close.

The KSE-100 index gained 2,201 points — 5.5pc in rupee terms and 15.4pc dollar-wise — in August.

The trading volume decreased 23.7pc to 181.3 million shares while the traded value went down 1.5pc to $33m on a day-on-day basis.

Stocks contributing significantly to the traded volume included K-Electric Ltd (15.13m shares), Unity Foods Ltd (10.97m shares), Engro Polymer and Chemicals Ltd (10.26m shares), Fauji Cement Ltd (6.9m shares) and WorldCall Telecom Ltd (6m shares).

Sectors contributing to the index performance included cement (75.3 points), chemical (32.3 points), fertiliser (23.1 point), power (22.9 points) and exploration and production (18.7 points).

Companies registering the biggest increase in their share prices in absolute terms were Bhanero Textile Mills Ltd (Rs95.62), Sapphire Textile Mills Ltd (Rs73.16), Al-Abbas Sugar Mills Ltd (Rs15.75), Shield Corporation Ltd (Rs11) and Service Industries Ltd (Rs8.34).

Shares that declined the most in rupee terms were Pakistan Services Ltd (Rs79.33), Philip Morris Pakistan Ltd (Rs41.99), Gatron Industries Ltd (Rs28.10), Millat Tractors Ltd (Rs17.24) and Excide Pakistan Ltd (Rs12.64).

Foreign investors remained net sellers as they offloaded shares worth $0.46m.

Published in Dawn, September 1st, 2022

Dear visitor, the comments section is undergoing an overhaul and will return soon.