KARACHI: Bulls lifted the benchmark index of the Pakistan Stock Exchange in the first half of the trading session on Tuesday.

However, subsequent profit-taking shaved off the earlier gains even though the index still closed in the positive territory, said JS Global. A lack of triggers resulted in a dull-volume session, it added.

According to Arif Habib Ltd, trading remained range-bound because investors’ participation was thin throughout the day owing to the weakening of the rupee against the dollar.

The rupee closed at 231.92 per dollar, down 0.91 per cent from the preceding close. Analysts said the demand for dollars was rising in view of the expected increase in the import bill following the nationwide floods.

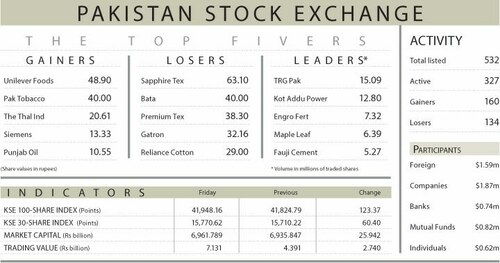

As a result, the KSE-100 index settled at 42,001.34 points, up 139.05 points or 0.33pc from a day ago.

The trading volume decreased 26.6pc to 118.5 million shares while the traded value went down 33.3pc to $16.7m on a day-on-day basis.

Stocks contributing significantly to the traded volume included Hascol Petroleum Ltd (10.21m shares), K-Electric Ltd (6.92m shares), Quice Food Industries Ltd (5.41m shares), JS Bank Ltd (5.03m shares) and WorldCall Telecom Ltd (4.26m shares).

Sectors that contributed to the index performance were banking (75 points), automobile assembling (35.7 points), cement (33.5 points), power (22 points) and textile (8.5 points).

Companies registering the biggest increase in their share prices in absolute terms were Sapphire Textile Mills Ltd (Rs41.09), Millat Tractors Ltd (Rs29.87), Colgate-Palmolive Pakistan Ltd (Rs27), Sanofi-Aventis Pakistan Ltd (Rs26.37) and Otsuka Pakistan Ltd (Rs10.30).

Shares that declined the most in rupee terms were Sapphire Fibres Ltd (Rs94), Siemens Pakistan Engineering Ltd (Rs37.33), Reliance Cotton Spinning Mills Ltd (Rs23), Pakistan Engineering Company

Ltd (Rs21.75) and Fazal Cloth Mills Ltd (Rs16.23). Foreign investors remained net buyers as they purchased shares worth $1.21m.

Published in Dawn, September 14th, 2022

Dear visitor, the comments section is undergoing an overhaul and will return soon.