The Pakistan Stock Exchange (PSX) witnessed a bearish trend for the fourth consecutive session this week as investors reacted to the US Federal Reserve raising the key interest rate again.

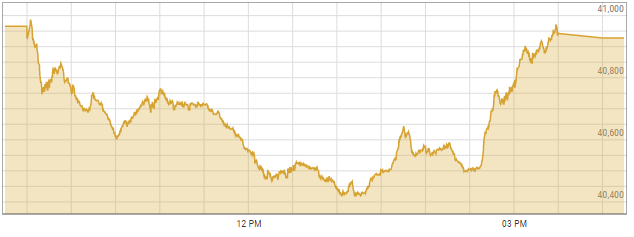

The benchmark KSE-100 index started plunging at 10am, reaching an intraday low of 547 points around 1pm. However, it recovered later in the day and closed at 40,927.95, down just 37.63 points or 0.09 per cent.

While commenting on the PSX’s early morning fall, First National Equities Limited Director Amir Shehzad said equities across the world had fallen after the US Federal Reserve’s decision and the PSX was also down in line with the global trend.

A day earlier, the Fed raised the interest rate for the third consecutive time by 75 basis points, continuing forceful action to tamp down inflation.

Federal Reserve Chair Jerome Powell has made it clear that officials will continue to act aggressively to cool the economy and avoid a repeat of the 1970s and early 1980s, the last time US inflation got out of control.

Shehzad said PTI Chairman Imran Khan’s announcement of launching a fresh movement amidst political uncertainty also dampened investor confidence.

In addition, investors were preferring to sell on fears of further rate hikes by the State Bank of Pakistan (SBP) as the rupee nears a record low against the dollar, he added.

Topline Securities CEO Mohammad Sohail also shared a similar view. “The market is mainly down due to rising interest rate and falling currency. This trend has been observed globally because the Fed is aggressively increasing interest rates and all markets and other regional currencies are down,” he commented.

Head of Research at Intermarket Securities, Raza Jafri, agreed that the KSE-100 was tracking the decline in world markets after the Fed hike. He added, however, that “domestic political noise is also affecting sentiment, and temporarily overshadowing positives such as a much reduced current account deficit for August and positive statements from US Special Envoy for Climate Change John Kerry regarding potential US assistance for helping rebuild resilient infrastructure in Pakistan.”

Later, former PSX director Zafar Moti said the benchmark index recovered sharply, reversing nearly all of the day’s losses, after the Islamabad High Court (IHC) deferred contempt proceedings against Imran and the former premier apologised to the court.