Bullish momentum continued at the Pakistan Stock Exchange (PSX) on Tuesday as the benchmark KSE-100 index started gaining shortly after trading began.

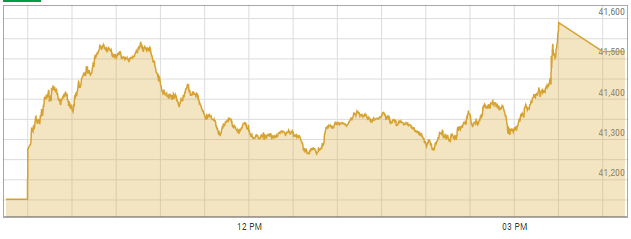

The KSE-100 index gained 366.69 points, or 0.89 per cent, to close at 41,518.23 points.

It saw an intraday high of 438.35 points, or 1.06pc, around 3:30pm.

Salman Naqvi, head of research at Aba Ali Habib Securities, said the primary reason for the index’s rise was Ishaq Dar’s upcoming return as finance minister.

“The effect was seen on the dollar which had been going up and creating problems. It has weakened today,” he pointed out, referring to the PKR recovering by another Rs3.32 against the greenback.

“A lot of pending issues are expected to be resolved with Dar’s return such as privatisation and offloading of shares to different countries,” he commented.

Naqvi also attributed the gains to expectations that Pakistan is expected to be removed from the Financial Action Task Force’s (FATF) grey list in its meeting on October 24.

“Relations with the United States have improved which is a welcome development. Donor agencies and friendly countries are helping [deal with the floods]. Crude prices are going down in the international market which will have a positive effect on Pakistan’s economy.”

First National Equities CEO Ali Malik also shared Naqvi’s view. “The impression is that Dar is a strict administrator and go-getter. He achieves results of his liking, so the market has a lot of expectations tied to him.”

Pakistan was expected to get pledges of around $25-30 billion for flood relief efforts in a fundraising event due to be held in France later this year, he added.

“Investor confidence has been restored and there are indications that elections will be held on time,” he said, adding that there were several positive economic developments such as a decline in crude oil prices in the international market and freight charges slumping, which would lower the import bill and inflation.

Former PSX director and AKY Securities CEO Ameen Yousuf said the index gained because of a number of reasons, including the rupee’s sharp recovery, expectations of lower inflation figures and possible reduction in domestic fuel prices.

“It is expected that the situation will improve in the coming days and foreign inflows will be received. The World Bank has also promised some amount,” he noted.

He said incoming finance minister Dar would face limitations in helping the rupee strengthen. “He might take administrative measures which stabilise the local currency … It appears the worst is ending and things will improve in the coming days.”

However, Dalal Securities CEO Siddique Dalal cautioned that while the market rose after Dar’s return, it would likely not be sustainable because there was “no positive news”.

While Dar would have an advantage over his predecessor Miftah Ismail because of the decline in oil prices and commodities such as wheat and soybean, it would not be long-lasting because “the underlying problems remain”, he commented.

Revenue collection would be reduced in the aftermath of the floods, Dalal noted, adding that flood recovery would take two-three years.