The top priority accorded by Finance Minister Ishaq Dar to curb speculative forex trading, combat inflation and bring down the interest rate in that order has its own merit but is seen by many as an inadequate and not fault-free response to pull the economy out of the current rot.

While still in the initial phase of implementation focused on the recovery of the national currency, his initiatives have evoked a sharp divergence of views on their outcomes. The rupee cumulatively regained Rs14.07 or 5.8 per cent in eight days ending October 4. It is yet to be seen whether this trend can be sustained.

A stronger dollar has become a major problem for developing economies and emerging markets. Yet one can witness some positive developments. A strong greenback has possibly prompted Washington ‘to keep (cheaper) Russian oil available in the market for lower and middle-income countries. Pakistan would be a beneficiary of the US decision.

And the latest annual report of the United Nations Conference on Trade and Development (UNTAD) has urged central banks of developed countries to loosen their belts. UNCTAD says financial tightening risked pushing the world into grim, prolonged stagnation. The report argued that relying on higher interest rates without generating a recession is an imprudent gamble.

In the current volatile domestic and global currency markets, usual interventions to stabilise the exchange rate do not work

Former finance secretary Waqar Masood Khan strongly believes that a recession-led drop in prices of key commodities will help our terms of trade and ease our external and inflationary pressures. In the first quarter of this fiscal year trade deficit dropped year-on-year by 21.42pc to $9.2 billion. The YoY Consumer Price Index has come down to 23.2pc.

In the current volatile domestic and global currency markets, usual interventions to stabilise the exchange rate do not work. Noted analyst Dr Farrukh Saleem says in just over the past year, the Reserve Bank of India failed to defend the falling Indian rupee, having lost $100 billion in the process. Bangladesh adopted a different approach. Its central bank recently ‘ordered six banks to remove treasury chiefs amid the dollar crisis.’ Pakistan does not have enough forex reserves to curb speculative activity in the currency market.

In the latest move, the State Bank of Pakistan governor Jamil Ahmed informed a parliamentary panel that an enquiry had been initiated against top banks suspected of being involved in undue profit-making in exchange rate variations before taking action against the culprits.

Earlier, to curb speculative activity, the central bank had amended foreign exchange regulations to promote documentation and transparency in the foreign exchange transactions between exchange companies. The transactions were required to be registered with banks.

It has surfaced that the freeze on petroleum development levy (PDL) did not have the International Monetary Fund’s (IMF) approval, which former finance minister Miftah Ismail considered ‘reckless.’ Dar responded by asserting that “I’ve been dealing with the IMF for the last 25 years. I’m the only humble person who has completed an IMF programme.’

Minister of State for Finance Dr Ayesha Ghouse Pasha clarified that the government still had more time to complete PDL increases to the target set under the IMF programme.

Dr Saleem says the strengthening of the national currency by Rs9 in just four trading sessions has brought down our foreign debt by Rs1.2 trillion in rupee terms. It is no intervention in the market but ‘the power of the (Dar’s) message.’

Dar considers artificial appreciation of the dollar against the rupee as ‘the mother of all evils’ He believes that the rupee is undervalued and its actual value is less than Rs200 against the dollar. He says the real worth of the local currency will be restored.

However, it is feared that a cheaper dollar will encourage imports and adversely impact the current account deficit. Miftah Ismail says, “We offer loans to the rich, and they give a push to imports which, in turn, slows down the economy.” Miftah termed the country’s growth model flawed, safeguarding manufacturers at the cost value-addition.

Upward social mobility is being denied to an overwhelming majority of the country’s citizens, lamented Miftah Ismail while addressing an award-giving ceremony organised by the Management Association of Pakistan. He added that almost all rich Pakistanis are beneficiaries of generational wealth.

In his article on ‘Redefining economic paradigm,’ political economist Shakeel Ahmed Ramay says wealthy people accumulate more wealth without undertaking any productive activity. The state will have to reconsider the balance between the private sector, markets and the living needs of the people.

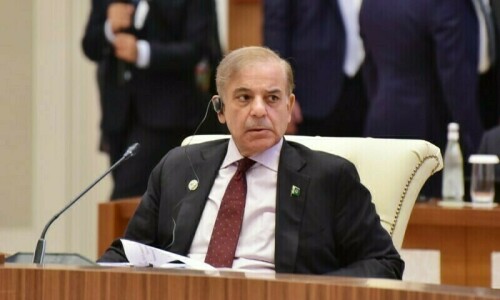

Earlier the Shahbaz government decided to focus on setting up solar panels for households, tube wells, hospitals, hotels etc, to cut the import of gas and petroleum products. And efforts have been renewed to boost IT-related exports and reduce dependence on foreign debts. But former finance minister Shaukat Tarin says IT freelancers have parked $3-4bn abroad and shying away from bringing money into the country due to high taxes.

In its latest report on the economic outlook, the Finance Ministry said the increase of Rs3.8tr in public debt in 2021-22 was due to the depreciation of the rupee as the exchange rate slipped from Rs157.3 to a dollar in June 2021 to Rs204.4 in June 2022. And the surge in debts was mainly attributable to exchange rate depreciation rather than excessive external borrowings.

The share of external debt in the total public debt increased from 34pc in 2020-21 to 37pc in 2021-22. Analysts say it is heading towards the maximum limit of 40pc of public debt.

To improve the balance of payments, it was after a prolonged legislative delay that the Exim Bank of Pakistan (EBoP) formally came into operation on October 1. EBoP will provide innovative products to support the growth of exports and foreign direct investment by mitigating related risks. It will also provide an enabling environment and level-playing field for domestic-based exports.

To quote a China Daily analyst, the crises and challenges now facing humanity are not only numerous but multidimensional, multi-layered and intertwined. An integrated approach is required to manage this all-embracing crisis. The fundamentals of the economy have to be improved.

Published in Dawn, The Business and Finance Weekly, October 11th, 2022