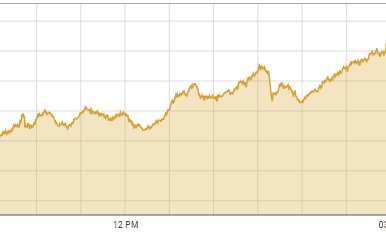

KARACHI: The shares market witnessed a range-bound session on Tuesday as investors chose to book profits.

Arif Habib Ltd said the benchmark index failed to continue its upward momentum despite opening in the positive zone. Sluggish participation led the benchmark to close in the red zone, it added.

The trading volume remained healthy in main-board stocks while hefty volumes were recorded in third-tier stocks.

Another reason for negative sentiments on the bourse was the downgrade of big Pakistani banks that credit rating agency Moody’s announced following the downgrade of the country’s sovereign credit rating.

Reduced estimates of the economic growth rate for 2022-23 also put a dampener on the investors’ sentiments.

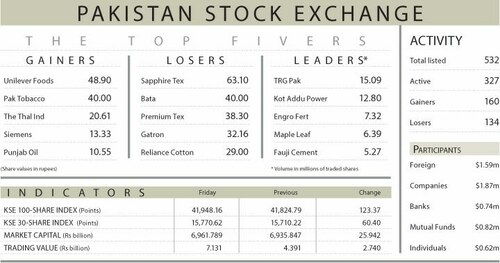

As a result, the KSE-100 index settled at 42,155.48 points, down 56.16 points or 0.13 per cent from the preceding session.

The trading volume increased 26.9pc to 304.8 million shares while the traded value went down 6.5pc to $45.2m on a day-on-day basis.

Stocks contributing significantly to the traded volume included WorldCall Telecom Ltd (39m shares), Cnergyico PK Ltd (34.12m shares), Pakistan Refinery Ltd (32.4m shares), Pak Elektron Ltd (27.37m shares) and Ghani Global Holdings Ltd (14.89m shares).

Sectors that contributed negatively to the index performance were technology (-112.1 points), cement (28 points), exploration and production (7.3 points), vanaspati and allied industries (6.5 points) and textile composite (6.5 points).

Companies registering the biggest increase in their share prices in absolute terms were Sapphire Textile Mills Ltd (Rs59), Reliance Cotton Spinning Mills Ltd (Rs27), JDW Sugar Mills Ltd (Rs23.38), Murree Brewery Company Ltd (Rs23) and the Thal Industries Corporation Ltd (Rs20.49).

Shares that declined the most in rupee terms were Nestle Pakistan Ltd (Rs70), Bata Pakistan Ltd (Rs63.56), Rafhan Maize Products Company Ltd (Rs50), Gatron Industries Ltd (Rs28.35) and Mari Petroleum Company Ltd (Rs22.37).

Foreign investors remained net buyers as they purchased shares worth $0.28m.

Published in Dawn, October 12th, 2022