KARACHI: The shares market observed a negative session on Wednesday on the back of poor participation from investors.

Arif Habib Ltd said the benchmark index traded in the red zone for the most part of the trading session. The trading volume remained dry in main-board stocks while third-tier shares continued being board leaders. In particular, the technology sector remained in the limelight.

JS Global said the market sentiment remained bearish owing to investors’ concerns about the economic outlook and the worsening geopolitical situation. “Going forward, we expect range-bound activity to continue,” it said while recommending that investors should treat any downside as an opportunity to buy shares in banking and exploration and production sectors.

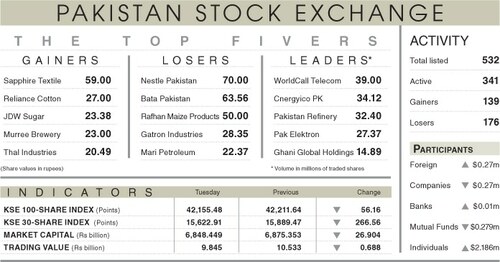

As a result, the KSE-100 index settled at 42,007.14 points, down 148.34 points or 0.35 per cent from the preceding session.

The trading volume decreased 21.7pc to 238.7 million shares while the traded value went down 20.3pc to $36m on a day-on-day basis.

Stocks contributing significantly to the traded volume included K-Electric Ltd (34.44m shares), WorldCall Telecom Ltd (30.54m shares), Telecard Ltd (16.27m shares), Pakistan Refinery Ltd (9.52m shares) and Cnergyico PK Ltd (9.37m shares).

Sectors that contributed to the index performance were technology (-218.5 points), cement (-39.2 points), chemical (-11.6 points), vanaspati and allied industries (-10.9 points) and exploration and production (-7.8 points).

Companies registering the biggest increase in their share prices in absolute terms were Nestle Pakistan Ltd (Rs200), Reliance Cotton Spinning Mills Ltd (Rs36), JDW Sugar Mills Ltd (Rs25.13), Mari Petroleum Company Ltd (Rs17.95) and Shield Corporation Ltd (Rs16.83).

Shares that declined the most in rupee terms were Sanofi-Aventis Pakistan Ltd (Rs85.50), Bhanero Textile Mills Ltd (Rs84.37), Premium Textile Mills Ltd (Rs54), Colgate-Palmolive Pakistan Ltd (Rs46.97) and Pakistan Tobacco Company Ltd (Rs40).

Foreign investors remained net sellers as they offloaded shares worth $0.26m.

Published in Dawn, October 13th, 2022

Dear visitor, the comments section is undergoing an overhaul and will return soon.