KARACHI: Trading on the stock exchange opened on a lacklustre note on Monday amid investors’ concerns about the local and international political situation, said JS Global.

The falling value of the rupee against the dollar as well as a rising level of confrontation between the government and the opposition played the role of a dampener.

“Going forward, we expect the market to further deteriorate over macro-economic concerns and the geopolitical situation. We, therefore, recommend investors to adopt a cautious approach,” it added.

According to Arif Habib Ltd, the session stayed range-bound as the index shed points towards the end of trading because of political unrest. Volumes declined dramatically in the main-board shares but decent trading was recorded in third-tier stocks.

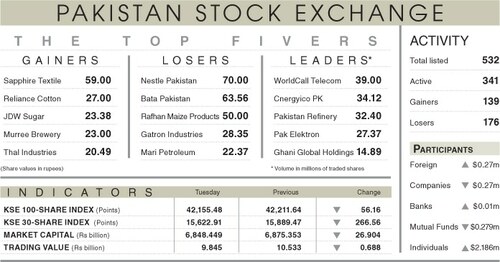

As a result, the KSE-100 index settled at 41,755.45 points, down 193.05 points or 0.46 per cent from the preceding session.

The trading volume decreased 56.1pc to 144.3 million shares while the traded value went down 51.5pc to $21.3m on a day-on-day basis.

Stocks contributing significantly to the traded volume included WorldCall Telecom Ltd (18m shares), Dewan Cement Ltd (6.78m shares), Lotte Chemical Pakistan Ltd (5.77m shares), Hascol Petroleum Ltd (5.31m shares) and TRG Pakistan Ltd (4.9m shares).

Sectors that contributed negatively to the index performance were exploration and production (49.5 points), cement (32.1 points), technology and communication (15.2 points), commercial banking (14.7 points) and chemical (14.2 points).

Companies registering the biggest increase in their share prices in absolute terms were Rafhan Maize Products Company Ltd (Rs700), Sanofi-Aventis Pakistan Ltd (Rs57), Unilever Pakistan Foods Ltd (Rs50.50), Philip Morris Pakistan Ltd (Rs38.92) and Premium Textile Mills Ltd (Rs33.30).

Shares that declined the most in rupee terms were Sapphire Fibres Ltd (Rs76.52), Colgate-Palmolive Pakistan Ltd (Rs46.80), Pakistan Tobacco Company Ltd (Rs31.31), Murree Brewery Company Ltd (Rs19.90) and the Premier Sugar Mills Ltd (Rs10).

Foreign investors remained net sellers as they offloaded shares worth $0.77m.

Published in Dawn, October 18th, 2022