Stocks continued to fall for the third consecutive day on Friday, with analysts attributing the slump to the PTI's long march and investors' shifting positions.

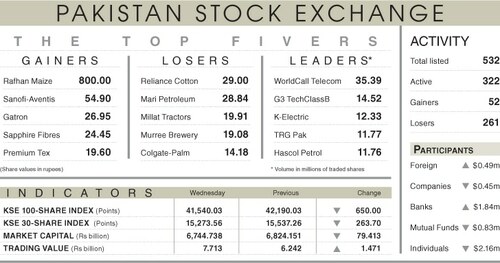

The benchmark KSE-100 index lost 462.53 points, or 1.11 per cent, by the session's end to close at 41,140.33 points.

Aba Ali Habib Securities' Salman Naqvi said the market had been under pressure for the last few sessions, the primary reason for which was political instability and the PTI's long march to Islamabad, which has begun from Lahore today. The march has created uncertainty, he added.

A large number of PTI supporters had gathered in Lahore's Liberty Chowk, from where Imran Khan is leading the anti-government protest march that is scheduled to reach Islamabad on November 4. The purpose of the march is to pressure the government to call early election in the country.

Naqvi further said that investors had taken a back seat, offloading their positions out of fear of a law and order situation arising.

At least 13,086 personnel — 4,199 Islamabad police officials, 1,022 from Sindh police, 4,265 FC personnel, and 3,600 Rangers — had been deployed in different areas of the capital to deal with the protest. Interior Minister Rana Sanaullah warned today that the government would deal with long march participants with an iron hand and take “strict action” if they attempted to break the law and create a law and order situation in the capital.

Naqvi also attributed today's slump to the "rollover week", the last week of the month, when future contracts are to be settled or rolled over to the next month and the stock market generally comes under selling pressure.

"It is the last day [of the month] to offload positions, which is why the market is under pressure," he commented.

The analyst said the country's political situation would determine the market's direction next week.

"If no law and order situation is created, the market can definitely go upwards as the price-to-earnings ratio is very attractive. The prime minister has signed good agreements [during his visit to] Saudi Arabia and good news is expected from his China visit.

"Prior to this, we exited FATF's (Financial Action Task Force) grey list. We have not seen an upwards trend yet only because of political instability," he said.

During his visit to Saudi Arabia earlier this week, Prime Minister Shehbaz Sharif said that Pakistan was “ripe for market innovation” and the country was ready to reach out to potential investors for the future of its upcoming generations.

In an address at the Future Investment Initiative Summit in Riyadh — an annual feature since 2017 — the premier said Pakistan was uniquely placed to leverage dynamic technological changes.

First National Equities CEO Ali Malik also attributed the slump in stocks and the low trading volume to the prevailing political uncertainty.

"During the week it will take the march to reach Islamabad, the movement of trade goods through G.T. Road will remain affected and the economy will slow down. There are also fears of a law and order situation. Investor interest will only be rekindled once the march ends.

"Even though company earnings and dividends have been very good, investors are on [the backseat right now]," he added.