KARACHI: The Pakistan Stock Exchange observed yet another positive session on Friday on the back of the news that the country will get a financial package from friendly countries.

Arif Habib Ltd said the benchmark opened in the positive territory but lacklustre activity led the index to lose 96.39 points at the close of the pre-Friday prayer session.

However, the benchmark rebounded once trading resumed.

Investors hunted for stocks because of Finance Minister Ishaq Dar’s announcement about a $13 billion package from China and Saudi Arabia. Volumes remained stable overall while healthy activity was observed in the oil and exploration sector.

As for material announcements, JS Bank Ltd told investors it acquired 89.3 million ordinary shares (7.8 per cent of paid-up capital) of BankIslami Pakistan Ltd from NBD Bank PSJC.

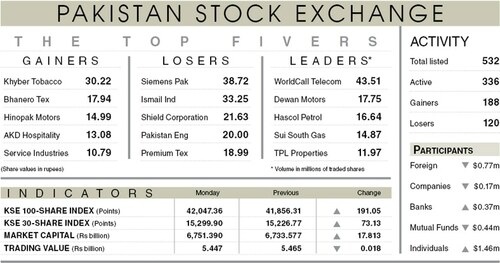

The KSE-100 index settled at 43,092.95 points, up 191.68 points or 0.45pc from the preceding session.

The trading volume decreased 20.8pc to 232.8m shares while the traded value went down 25.4pc to $34.4m on a day-on-day basis.

Stocks contributing significantly to the traded volume included Cnergyico PK Ltd (21.1m shares), WorldCall Telecom Ltd (17.9m shares), TPL Properties Ltd (15.1m shares), Pakistan Refinery Ltd (14.8m shares) and Oil and Gas Development Company Ltd (12.5m shares).

Sectors that contributed to the index performance were exploration and production (129.3 points), technology and communication (98.4 points), oil marketing (22.8 points), tobacco (13.1 points) and food and personal care products (12.8 points).

Companies registering the biggest increase in their share prices in absolute terms were Nestle Pakistan Ltd (Rs249), Pakistan Tobacco Company Ltd (Rs39.33), Siemens Pakistan Engineering Ltd (Rs37.83), Philip Morris Pakistan Ltd (Rs18.75) and Suraj Cotton Mills Ltd (Rs9.50).

Shares that declined the most in rupee terms were Bata Pakistan Ltd (Rs99), Pakistan Services Ltd (Rs62.25), Khyber Tobacco Company Ltd (Rs35.27), Shield Corporation Ltd (Rs18.15) and AKD Hospitality Ltd (Rs13.29).

Foreign investors remained net buyers as they purchased shares worth $0.77m.

Published in Dawn, November 12th, 2022