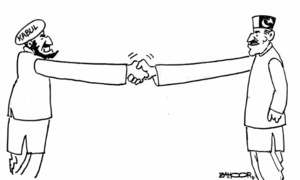

ISLAMABAD: Pakistan and the International Monetary Fund (IMF) had another round of engagement on Thursday but could not finalise a schedule for formal talks on the overdue ninth review of a $7 billion loan programme amid a lack of clarity on flood-related financial requirements for this fiscal year and declining revenue stream in the wake of import controls.

“Dates for the ninth review could not be finalised,” a senior official told Dawn after Finance Minister Ishaq Dar had an online meeting with IMF’s mission chief to Pakistan, Nathan Porter, on Thursday.

Mr Dar reiterated the government’s commitment to “successfully completing the IMF programme”, the finance ministry said in a statement, apparently to pacify jittery markets.

The talks, originally due in the last week of October, were rescheduled to Nov 3 and then kept on facing delays following gaps in estimates by the two sides.

Govt fails to finalise schedule amid lack of clarity on flood-related financial requirements, declining revenue

“It was agreed that expenditure estimates for flood-related humanitarian assistance during the current year will be firmed up along with estimates of priority rehabilitation expenditure,” the finance ministry said, adding that the IMF indicated its willingness to sympathetically view the targeted assistance for poor and vulnerable citizens, especially those affected by recent flooding.

The two sides discussed the progress made with the ongoing IMF programme, particularly the impact of floods on the macroeconomic framework and targets for the current year.

“In this regard, engagement at the technical level shall be expeditiously concluded for proceeding with the 9th review,” the statement said.

Under the rules of the game, all the fiscal and monetary policy numbers (both past and future) are agreed upon at the technical level so that minor adjustments can be made at the policy level and then taken to the executive board of the IMF for approval.

Pakistan would now represent all flood-related expenditures in the budget, along with specific heads and schedules of spending.

The sources said a few policy actions had been delayed over the past few weeks owing to the prevailing political uncertainty and declining trend in revenue collection. While authorities had been looking around for additional revenues, including on profitability of the financial sector and higher revenue stream from the State Bank’s profits, a senior official said there was no discussion on the new tax burden. Some outstanding issues also pertained to the energy sector and need to be addressed, another official said.

The authorities have already hinted at requests for a series of waivers on performance criteria owing to flood losses and the IMF’s push for staying on course committed tax-to-GDP ratio of at least 11pc.

“Circumstances are difficult, but we have to remain in the IMF programme and make more structural adjustments,” Minister of State for Finance Dr Aisha Ghaus Pasha had told a parliamentary panel early this week.

Pakistan was behind the tax-to-GDP ratio target by almost 0.8pc of GDP, mainly because of GDP’s rebasing that enhanced the size of the economy.

On the other hand, expenditures exceeded targets in July-September and the revenue collection trend appeared to decline because of import compression.

Pakistan would desire the IMF to grant a number of waivers on performance criteria, but these had to be precisely worked out by the two sides at the staff level.

Based on Pakistan’s specific slippages and demands for adjustments, the IMF mission would firm up its stance and take Pakistan’s case to the executive board of the IMF for approval of the waivers.

Published in Dawn, November 18th, 2022