• Minister says Islamabad committed to IMF programme

• Efforts being made to reform tax collection system

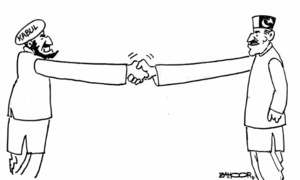

ISLAMABAD: Amid claims by former prime minister Imran Khan that default is staring Pakistan in the face and reports about delay in formal talks with IMF on the ninth review of $7bn loan programme, Minister of State for Finance and Revenue Aisha Ghaus Pasha assured the nation on Friday that the country was not facing any danger of going to default.

The minister held out the assurance in the National Assembly when Mussarat Rafiq Mahesar of Pakistan Peoples Party (PPP) put a direct question to her, “If Pakistan is going to default?”

“Alhamdulillah [Thank God], there is no such possibility. Yes, we were worried when we took over the government [in April] because at that time the IMF programme was suspended and the avenues of getting external finances were closed for us,” said the minister.

However, she claimed, the situation had improved a lot after the government took some “very difficult decisions” and revival of the IMF programme.

Ms Pasha said it was a fact that the country in the past was unable to borrow money from other multilateral and bilateral agencies and even commercial market to finance its external needs due to the suspension of IMF programme.

However, she pointed out, after the successful seventh and eighth reviews of the IMF programme, there was no immediate threat of Pakistan going to default. Instead, she claimed, the country’s exports had improved, foreign remittances were coming and foreign direct investment was getting better.

The minister stated that Pakistan was now on the IMF’s track and committed to its programme.

In response to another question, Ms Pasha informed the house that at present Pakistan’s 50 per cent economy was estimated to be undocumented. However, while quoting different research studies, she said the size of Pakistan’s informal economy was estimated to be 35.6pc.

According to the World Bank, she said, the informal sector was one-third of the country’s GDP (Gross Domestic Product).

She said efforts were being made to enhance the size of formal economy, adding that a well-structured taxation policy and effective enforcement thereof could play an important role in achieving this objective. The government was making all out efforts to bring reforms to the tax collection system in a bid to generate maximum income to create facilities for taxpayers.

The minister stressed the need for developing a civic sense in every Pakistani so that he or she should pay due taxes honestly.

She lamented that Pakistan’s tax-to-GDP ratio was only 9pc, which was considered to be low in the world.

Forex reserves

Meanwhile, in a written reply to a question of another PPP MNA Shamim Ara Panhwar, Finance Minister Ishaq Dar informed the house that the total value of the country’s foreign exchange reserves stood at $13,721.9 million on Nov 4. Giving a break-up, he said, the foreign exchange reserves held by the State Bank stood at $7,957.9m and by commercial banks at $5,764m.

Responding to questions about the country’s foreign debt, Minister for Economic Affairs Sardar Ayaz Sadiq told the house that the previous Pakistan Tehreek-i-Insaf government had taken $47,105.85m loans between August 2018 and April 2022.

According to Mr Sadiq, the foreign loans and aid received by the present government from April 11, 2022 to Sept 30, 2022 amounted to $5,665.83m.

In response to a query, Minister for Privatisation Abid Hussain Bhayo informed the lawmakers that Services International Hotel, Lahore; property owned by the Federal Board of Revenue in Faisalabad; Heavy Electrical Complex, Taxila; Pakistan Steel Mills, Karachi; National Power Parks Management Co. Ltd and House Building Finance Company were on the list of active privatisation projects.

Moreover, he said, the privatisation of Pakistan Re-Insurance Company; First Women Bank Limited; Republic Motors land at Lahore and electric supply companies in Faisalabad, Islamabad, Lahore, Gujranwala, Multan, Peshawar, Hyderabad, Quetta, Sukkur and Tribal Electric Supply Company was also under the government’s consideration.

Published in Dawn, November 19th, 2022