KARACHI: The shares market observed another range-bound session on Wednesday owing to a lack of participation from investors.

Arif Habib Ltd said the market opened in the green zone but the index soon dipped into the red territory and stayed there for most of the trading session.

Market participation was lower than the previous session as the trading volume remained dry in mainboard stocks. However, decent volumes were recorded in third-tier stocks.

Sentiments were down also because of the unending political strife that have been going on for months. In addition, stretched-out talks between the government and the International Monetary Fund over the release of the next tranche of the loan necessary for the country’s balance of payments also led to the poor performance of stocks.

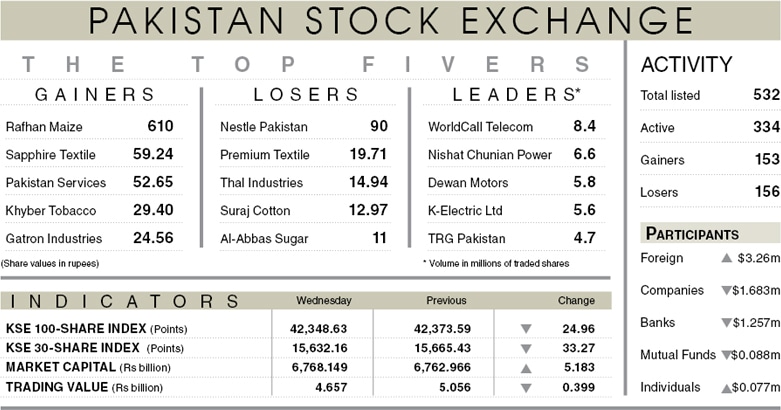

As a result, the KSE-100 index settled at 42,348.63 points, down 24.96 points or 0.06 per cent from the preceding session.

The trading volume decreased 13.7pc to 120.2m shares while the traded value went down 7.9pc to $20.8m on a day-on-day basis.

Stocks contributing significantly to the traded volume included WorldCall Telecom Ltd (8.4m shares), Nishat Chunian Power Ltd (6.6m shares), Dewan Motors Ltd (5.8m shares), K-Electric Ltd (5.6m shares) and TRG Pakistan Ltd (4.7m shares).

Sectors that contributed negatively to the index performance were commercial banking (79.9 points), technology and communication (17.3 points), power generation and distribution (18.2 points), chemical (8.2 points), automobile assembling (6.9 points).

Companies registering the biggest increase in their share prices in absolute terms were Rafhan Maize Products Company Ltd (Rs610), Sapphire Textile Mills Ltd (Rs59.24), Pakistan Services Ltd (Rs52.65), Khyber Tobacco Company Ltd (Rs29.40) and Gatron Industries Ltd (Rs24.56).

Shares that declined the most in rupee terms were Nestle Pakistan Ltd (Rs90), Premium Textile Mills Ltd (Rs19.71), the Thal Industries Corporation Ltd (Rs14.94), Suraj Cotton Mills Ltd (Rs12.97) and Al-Abbas Sugar Mills Ltd (Rs11).

Foreign investors were net buyers as they purchased shares worth $3.26m.

Published in Dawn, December 1st, 2022