KARACHI: Stock prices dropped on Tuesday as the ruling alliance and the main opposition party failed to end the stalemate on the issue of fresh general elections.

Arif Habib Ltd said worsening macroeconomic indicators undermined investors’ confidence and resulted in a significant reduction in the number of shares traded on the mainboard of the stock exchange. Third-tier stocks, however, continued to dominate the trading volume.

Analyst Ahsan Mehanti said the instability in the currency market as well as the latest data showing dismal sales of cement and petroleum products led to a bearish trend on the exchange.

In addition, uncertainty about the outcome of talks between the federal government and the International Monetary Fund also dampened share prices.

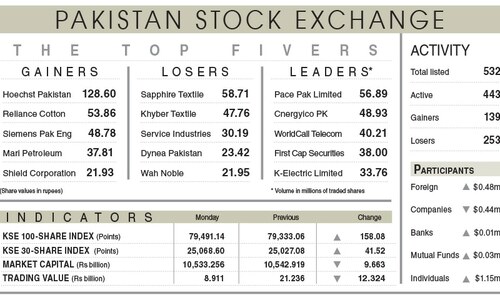

As a result, the KSE-100 index settled at 41,539.94 points, down 72.73 points or 0.17 per cent from the preceding session.

The overall trading volume increased 4.3pc to 131.7 million shares while the traded value went up 20.1pc to $17.4m on a day-on-day basis.

Stocks contributing significantly to the traded volume included Dewan Cement Ltd (11.3m shares), WorldCall Telecom Ltd (9.8m shares), Dewan Motors Ltd (9.8m shares), TPL Properties Ltd (8.6m shares) and Kohinoor Spinning Mills Ltd (7.2m shares).

Sectors that contributed to the index performance were automobile assembling (-27.7 points), chemical (-18.7 points), oil marketing (-16.6 points), commercial banking (-16 points), investment banking (-13.6 points).

Companies registering the biggest increase in their share prices in absolute terms were Pakistan Services Ltd (Rs49.29), Shield Corporation Ltd (Rs21.38), the Thal Industries Corporation Ltd (Rs18.87), Archroma Pakistan Ltd (Rs10.88) and Suraj Cotton Mills Ltd (Rs15).

Companies that recorded the biggest declines in their share prices in absolute terms were Sapphire Fibres Ltd (Rs78.71), Colgate-Palmolive Pakistan Ltd (Rs39.09), Pakistan Tobacco Company Ltd (Rs37), Pakistan Engineering Company Ltd (Rs21) and Reliance Cotton Spinning Mills Ltd (Rs17.56).

Foreign investors were net buyers as they purchased shares worth $2.17m.

Published in Dawn, December 7th, 2022

Dear visitor, the comments section is undergoing an overhaul and will return soon.