KARACHI: Stock prices plummeted on Thursday after bouncing within a small range on the back of a deteriorating macroeconomic situation.

Analyst Ahsan Mehanti said the shares market came under pressure as investors reacted to a report by international investment bank JPMorgan, which projected the central bank raising the policy rate by 400 basis points to 20 per cent by the end of 2022-23 amid high inflation.

In addition, a declining trend in remittances coupled with a recent business confidence survey held by the foreign investors’ chamber of commerce that showed an unfavourable business environment also unnerved investors.

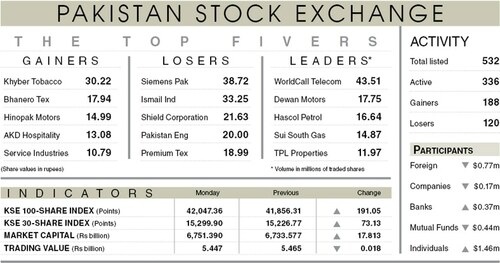

As a result, the KSE-100 index settled at 41,651.61 points, down 167.68 points or 0.4pc from the preceding session.

The overall trading volume increased 2.9pc to 227.8 million shares. The traded value went down 30.8pc to $18.1m on a day-on-day basis.

Stocks contributing significantly to the traded volume included Kohinoor Spinning Mills Ltd (25.2m shares), Hum Network Ltd (23.7m shares), Hascol Petroleum Ltd (13m shares), Dewan Farooque Spinning Mills Ltd (12.8m shares) and Dewan Cement Ltd (12.8m shares).

Sectors that contributed to the index performance were technology and communication (-55.8 points), commercial banking (-36.7 points), cement (-35.8 points), power generation and distribution (-24.2 points), pharmaceutical (-21.2 points).

Companies registering the biggest increase in their share prices in absolute terms were Pakistan Services Ltd (Rs78.63), Blessed Textiles Ltd (Rs14.99), Tandlianwala Sugar Mills Ltd (Rs4.86), Nagina Cotton Mills Ltd (Rs4.68) and Millat Tractors Ltd (Rs4.26).

Companies that recorded the biggest declines in their share prices in absolute terms were Sanofi-Aventis Pakistan Ltd (Rs78.75), Shield Corporation Ltd (Rs23.09), Pakistan Engineering Company Ltd (Rs18.99), Indus Dyeing and Manufacturing Company Ltd (Rs15.66) and Ferozsons Laboratories Ltd (Rs10.12).

Foreign investors were net sellers as they offloaded shares worth $0.33m.

Published in Dawn, December 9th, 2022

Dear visitor, the comments section is undergoing an overhaul and will return soon.