KARACHI: The stock market observed lacklustre activity on Monday as investors sold stocks to book profits.

Topline Securities said worries about economic and political conditions kept investors on the sidelines.

Ahsan Mehanti of Arif Habib Corporation said stock prices went down across the board owing to the foreign exchange crisis that’s been hurting industrial units. Companies belonging to the manufacturing sector have been facing problems in opening the letters of credit because of a shortage of dollars.

In addition, uncertainty over the outcome of Pakistan-International Monetary Fund talks over the ninth review of the ongoing loan programme also played the role of a catalyst in the bearish close.

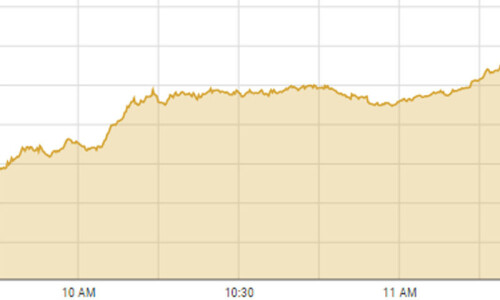

As a result, the KSE-100 index settled at 41,540.55 points, down 157.73 points or 0.38 per cent from the preceding session.

The overall trading volume decreased 30.2pc to 133.6 million shares. The traded value went down 9.7pc to $14.4m on a day-on-day basis.

Stocks contributing significantly to the traded volume included Dewan Motors Ltd (8.5m shares), WorldCall Telecom Ltd (7.2m shares), Dewan Farooque Spinning Mills Ltd (6.5m shares), Ghani Chemical Industries Ltd (6.4m shares) and Media Times Ltd (6.3m shares).

Sectors that contributed negatively to the index performance were chemical (33.2 points), commercial banking (32.6 points), automobile parts and accessories (16.9 points), oil marketing (15.8 points), food and personal care products (15.3 points).

Companies registering the biggest increase in their share prices in absolute terms were Premium Textile Mills Ltd (Rs44), Indus Motor Company Ltd (Rs19.14), Shield Corporation Ltd (Rs18.34), Abbott Laboratories Ltd (Rs8.13) and East West Insurance Company Ltd (Rs5.78).

Companies that recorded the biggest declines in their share prices in absolute terms were Unilever Pakistan Foods Ltd (Rs750), Nestle Pakistan Ltd (Rs131), Sanofi-Aventis Pakistan Ltd (Rs70.25), Mehmood Textile Mills Ltd (Rs35) and Siemens Engineering Pakistan Ltd (Rs24.13).

Foreign investors were net sellers as they offloaded shares worth $3.64m.

Published in Dawn, December 13th, 2022