The United States Federal Reserve moderated its all-out campaign to cool inflation on Wednesday, lifting the benchmark lending rate by a half percentage point though warning there is still “some ways to go”.

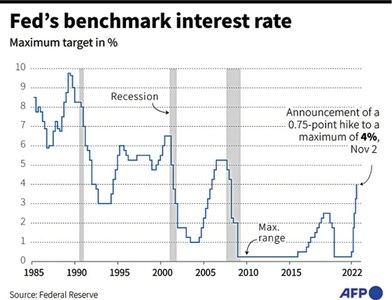

America’s central bank has taken aggressive moves to ease demand in the world’s biggest economy, hiking rates seven times this year with interest-sensitive sectors like housing already reeling from tightening policy.

Its latest increase takes the rate to 4.25-4.50 per cent, the highest since 2007.

But officials signalled that their battle to cool the US economy is not yet over. In a statement, the Fed’s policy setting Federal Open Market Committee (FOMC) said it “anticipates that ongoing increases in the target range will be appropriate” to reach a stance restrictive enough to rein in inflation.

A quarterly forecast released with Wednesday’s decision also saw policymakers downgrade US economic growth to 0.5pc in 2023, just narrowly avoiding a contraction.

They also raised their unemployment and inflation estimates for next year.

“Fifty basis points is still a historically large increase, and we still have some ways to go,” Fed Chair Jerome Powell told reporters in a press briefing after the rate announcement, and markets slumped on the central bank’s signals.

In their projections, policymakers expect rates would land higher than expected at 5.1pc next year, according to a median forecast.

“I wouldn’t see us considering rate cuts until the committee is confident that inflation is moving down to two per cent in a sustained way,” Powell said.

‘More evidence’

While consumer inflation eased in October and November, Powell said “it will take substantially more evidence to give confidence that inflation is on a sustained downward path.” Households have been squeezed by red-hot prices, with conditions worsened by surging food and energy costs after Russia’s invasion of Ukraine, and fallout from China’s zero-Covid measures.

To make borrowing more expensive, the Fed has raised interest rates seven times including four bumper 0.75-point increases.

Asked if a “soft landing” for the economy remains achievable, Powell said this would be more likely if lower inflation readings persist.

Nancy Vanden Houten of Oxford Economics said: “The projections don’t explicitly call for a recession, although a rise in the unemployment rate by as much as the Fed now forecasts is consistent with a recession.” The Fed lifted its median jobless rate forecast to 4.6pc on Wednesday.

But Powell said: “I don’t think anyone knows whether we’re going to have a recession or not, and if we do, whether it’s going to be a deep one or not.”

‘Hawkish’

“The new forecasts are more hawkish than we expected,” said economist Ian Shepherdson of Pantheon Macroeconomics, referring to the higher inflation and unemployment rate expectations, and lower GDP growth projection.

“If policymakers implement all the hikes they now expect, they will have done too much,” he cautioned.

Analysts have warned that further tightening by the Fed risks cooling the economy at a time when it is already under pressure heading into 2023.

The latest increase suggests the Fed has “moved to phase two of its rate hiking cycle”, said Rubeela Farooqi of High Frequency Economics in a note.

This means it is shifting from its more aggressive path to “a slower pace of rate increases until rates are in a sufficiently restrictive stance”, she said.

Powell added on Wednesday that the Fed’s focus now is “on moving our policy stance to one that is restrictive enough to ensure a return of inflation to our two per cent goal over time”. Consumer inflation came in at 7.1pc year-on-year in November, according to government figures.

“We think that we’ll have to maintain a restrictive stance of policy for some time,” Powell said.

“Historical experience cautions strongly against prematurely loosening policy,” he added.