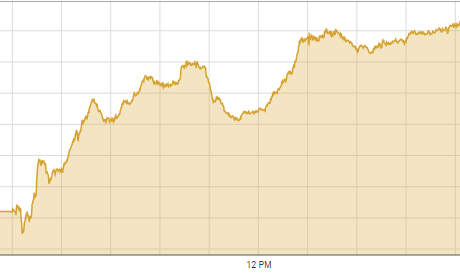

KARACHI: Share prices moved both ways on Wednesday before settling on the lower side as a result of uncertain macroeconomic conditions.

Arif Habib Ltd said the volume for mainboard stocks dropped while third-tier companies continued their dominance on the trading counter.

A lack of positive triggers on the market kept investors away from participation, said JS Global. According to analyst Ahsan Mehanti, dismal data on exports, down 16.6 per cent year-on-year, along with a drop in the cotton output by 37.23pc and a slump in petroleum sales by 11pc played a key role in in the bearish close.

As a result, the KSE-100 index settled at 40,539.30 points, down 91.34 points or 0.22pc from the preceding session.

The overall trading volume decreased 28.9pc to 142.9 million shares. The traded value went down 12.9pc to $19.1m on a day-on-day basis.

Stocks contributing significantly to the traded volume included Dewan Farooque Motors Ltd (10.8m shares), Sui Southern Gas Company Ltd (10.7m shares), Al-Shaheer Corporation Ltd (9.3m shares), Sui Northern Pipelines Ltd (8.9m shares) and WorldCall Telecom Ltd (7.2m shares).

Sectors contributing the most to the index performance were exploration and production (-49.4 points), commercial banking (-36.5 points), power generation and distribution (-17.7 points), engineering (-8.6 points) and oil marketing (-7.0 points).

Companies registering the biggest increases in their share prices in absolute terms were Rafhan Maize Products Company Ltd (Rs499), Premium Textile Mills Ltd (Rs34.97), Reliance Cotton and Spinning Mills Ltd (Rs26.09), Al-Abbas Sugar Mills Ltd (Rs24.25) and Pakistan Engineering Company Ltd (Rs21.56).

Companies that recorded the biggest declines in their share prices in absolute terms were Nestle Pakistan Ltd (Rs100), JDW Sugar Mills Ltd (Rs14.66), the Thal Industries Corporation Ltd (Rs14.35), Suraj Cotton Mills Ltd (Rs11.62) and Pak Suzuki Motor Company Ltd (Rs10.62).

Foreign investors were net buyers as they purchased shares worth $0.12m.

Published in Dawn, January 5th, 2023