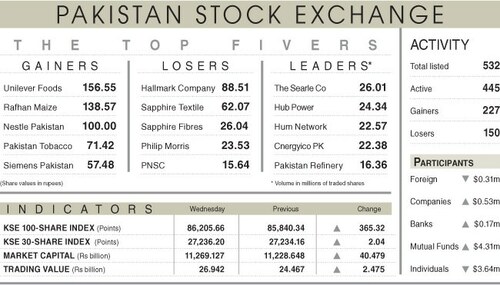

KARACHI: Oil refining and marketing company Cnergyico PK Ltd said on Friday the update about a shutdown in its refinery operations doesn’t fall under the purview of price sensitive information.

In response to an earlier letter from the Securities and Exchange Commission of Pakistan that sought explanation from the company over the refinery shutdown from Feb 2 to Feb 10 reported in the press, the company said the decision was in line with the crude oil vessel arrival timeline and that its operations in other business segments still continued.

With an aggregated throughput capacity of 156,000 barrels per day, Cnergyico PK is one of the five crude oil refining entities in the country. It also owns and operates Pakistan’s only floating port located 13km offshore in the Arabian Sea as well as a petroleum marketing business.

“As the non-availability of crude is significantly related to volatile crude oil prices and the massive devaluation of the rupee, it resulted in the refinery’s shutdown for a week. However, the petroleum marketing business remains functional,” it said.

Cnergyico PK has been facing working-capital constraints for some time, which led it to plan the refinery throughput as per the available funding. Subsequently, its refining units switch from production to cold circulation or shutdown, and back to production, as and when required, making the whole process “an established practice”.

“With a rising dollar-rupee parity, the existing working capital lines are not sufficient for any oil company, including Cnergyico PK,” it said.

In the corporate briefing session held on Oct 19, 2022, the company said the rising parity had created a shortage of working capital and that the company was not able to maintain its refinery throughput.

It said it has “adequate excess capacity” to accelerate production when the refinery starts operations as per the planned crude processing quantity.

“We have different business verticals in one listed company. If we start informing about these brief

shutdowns which don’t have a financial impact to the shareholders and investors, it will mislead them,” it said.

Published in Dawn, February 11th, 2023

Dear visitor, the comments section is undergoing an overhaul and will return soon.