KARACHI: The country’s overall foreign exchange reserves increased 2.3 per cent to $10.14 billion during the week ending on March 17. The figure crossed the $10bn mark for the first time since Jan 13.

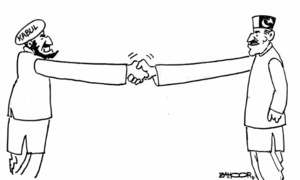

The State Bank of Pakistan’s (SBP) holdings also rose slightly on inflows from China, announced the central bank on Friday.

However, foreign exchange reserves of the central bank matter more as they are mostly used for external debt servicing. The SBP also pumps dollars into the interbank market to increase liquidity to meet demand, thus strengthening the exchange rate.

The central bank’s reserves increased by $280 million to $4.6bn during the week after it had received a $500 commercial loan from China. “After accounting for external debt repayments, SBP reserves increased by $280m to $4.599bn during the week,” the SBP said on Friday. Pakistan is facing difficulties in timely repayments of foreign debt due to dwindling forex holdings amid falling exports and remittances.

Total forex holdings, including those of banks, cross $10bn for first time since mid-Jan

Over the coming months, the government needs about $6bn to satisfy the IMF for the conclusion of lengthy negotiations. Staff-level negotiations with the lender are still unfinished as the lender is said to be demanding that Pakistan must submit written assurances from friendly countries for meeting the financing gap of $6bn before the release of the Fund’s $1.1bn tranche.

The increasingly lengthy talks with the IMF are costing the economy heavily with multiple negative impacts bringing Pakistan closer to default. The country’s economic managers believe that the release of the IMF tranche will unlock inflows from other sources, like friendly countries in the Middle East and China.

However, these countries are said to be monitoring developments on the political and economic fronts that currently plague the country. Over the past 11 months, neither crisis seems to be reaching any conclusion. It is also due to this uncertainty that the rupee has been losing value against the dollar and reached an all-time low of 283 in the interbank market.

The devaluation of the rupee is more visible in Dubai, where one dollar sells at Rs324. This is the rate at which importers in Pakistan are buying dollars since the SBP has banned the opening of letters of credit (LCs) and asked importers to arrange dollars on their own. The SBP reported that the foreign exchange reserves of commercial banks during the week ending on March 17 were $5.54bn, up 0.23pc from a week ago.

Published in Dawn, March 25th, 2023