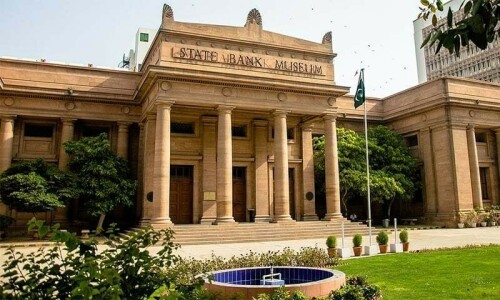

The State Bank of Pakistan (SBP) has removed all cash margin requirements on imports it had previously imposed under six circulars from 2017 to 2022, fulfilling another condition of the International Monetary Fund (IMF) to reach a staff-level agreement.

In a Banking Policy and Regulations Department circular dated March 24, the SBP said it was withdrawing the “existing Cash Margin Requirement (CMR) on import of items with effect from March 31, 2023”.

The announcement comes as the central bank’s foreign exchange reserves increased by $280 million to $4.6 billion during the week ending on March 17 on the back of inflows from China.

Cash-strapped Pakistan is in a race against time to implement measures to reach an agreement with the IMF on the completion of the ninth review of a $7bn loan programme, which began in 2019.

The much-awaited agreement with the lender, which has been delayed since late last year over a policy framework, would not only lead to a disbursement of $1.2bn but also unlock inflows from friendly countries.

Cash margins are the amount of money an importer has to deposit with their bank for initiating an import transaction, such as opening a letter of credit (LC), which could be up to the total value of the import.

Pakistan has a severe balance of payments problem, with its forex reserves reaching critical levels in the past few months. In such a situation, the central bank had stepped in to impose different types of curbs on imports as an attempt to preserve its dollars.

Cash margins are seen as a tool to discourage imports as the amount to be deposited beforehand with the bank increases the opportunity cost for importers.

In its latest circular, the SBP declared its past circulars — one each from 2017, 2018, 2021 and three from 2022 — to “stand withdrawn with effect from March 31”.

Past CMR

In 2017, the SBP had imposed 100pc cash margins on 404 items while in 2018, it had imposed the same on 131 items.

Then in 2021, it raised the total number of items with 100pc CMR to 525.

On April 7, 2022, the SBP had imposed a 100pc cash margin on another 177 items to reduce imports, which drastically hit the external account of the economy amid a ballooning import bill.

According to the April circular, banks had been mandated to obtain a 100pc cash margin on all items imported immediately.

In May 2022, three of the five telecom operators had even reached out to the SBP for the reversal of the 100pc CMR for the import of “almost all” telecom-related equipment that the companies usually source from abroad.

The representatives of Jazz, Telenor and Ufone had said the requirement was “extremely detrimental” to the industry.

Later, in August 2022, the government had relaxed the cash margins on imports from 100pc to 25pc and in some cases to zero. The standing cash margins were to remain in place till the end of the year.

However, on Dec 30, 2022, the SBP had extended the “timeline for maintaining CMR” till March 31, 2023.

Dear visitor, the comments section is undergoing an overhaul and will return soon.