ISLAMABAD: The coalition government has identified key risks to the next year’s budget and the medium-term macroeconomic outlook, including the current financial and operational performance of state-owned enterprises (SOEs), rising public debt, movement of interest and exchange rates by the State Bank of Pakistan, and climate change.

In an integrity statement submitted to parliament required under the Public Finance Management Act as part of the federal budget, Finance Minister Ishaq Dar and Finance Secretary Imdad Ullah Bosal have also highlighted that the Russia-Ukraine war, falling global growth and rising inflation could pose risks to the economic growth and sustainability of fiscal and monetary projections.

Strangely though, both the political and bureaucratic heads of the finance ministry did not see any political uncertainty, waning support of the International Monetary Fund (IMF) or upcoming general elections in the first half of the next fiscal year as disturbing events for the recently presented budget and the macroeconomy.

Editorial: Ishaq Dar, what have you done?

Under the Public Finance Management Act, 2019, the government is required to identify fiscal risks in the annual budget statement that have a reasonable chance of materialising over the fiscal year or over the medium term.

Govt also sees performance of SOEs, movement of exchange rate by SBP, Ukraine war, falling global growth as key challenges

Talking about the macroeconomic risks, the Ministry of Finance said the global economy had already entered 2023 with significant challenges, like persistent supply chain issues, inflationary pressures, prolonged Russia-Ukraine war, and catastrophic disasters like earthquakes and weather and climate-change events.

According to IMF estimates, global growth is projected to fall from an estimated 3.4 per cent in 2022 to 2.8pc in 2023, then rise to just 3pc in the following year.

The forecast for 2023 is below the historical (2000-19) average of 3.8pc. “The rise in central bank’s rates to fight inflation and Russia-Ukraine war continue to weigh on economic activity,” the finance ministry said, adding that the recent reopening of China had paved the way for the expected recovery.

Global inflation is expected to remain around 7pc in 2023 and 4.9pc in 2024, still above pre-pandemic (2017-19) levels of about 3.5pc. This situation in the major economies has impacted many developing economies, including Pakistan.

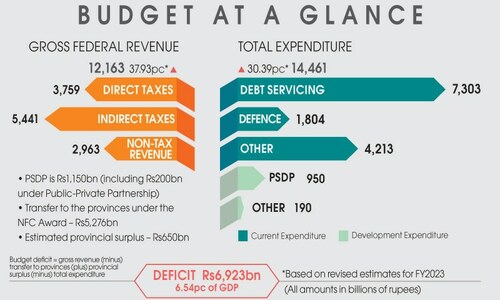

Secondly, Pakistan’s total public debt over the last five years has exceeded the prescribed limit of 60pc of GDP under the Fiscal Responsibility and Debt Limitation (FRDL) Act. This is primarily due to consistent fiscal deficits, averaging 6pc of GDP since 2010, that helped debt build up rapidly.

Total public debt, or unpaid borrowed funds carried by the government, can increase due to both budgetary and non-budgetary factors, such as unfavourable movements in interest and exchange rates — as has happened in the case of Pakistan, particularly over the last five years — and the realisation of contingent liabilities.

Under the FRDL Act, 2005, total public debt means debt of the government (both federal and provincial) serviced out of the consolidated fund, and debt owed to the IMF.

Thirdly, “given multivariate financial flows between the Government of Pakistan and its SOEs, their ongoing financial and operational performance is a considerable source of fiscal risk”, Mr Dar said, explaining the importance of the SOEs that provide a wide range of essential goods and services, and thus play a critical role in Pakistan’s socio-economic development.

Moreover, Pakistan’s 2021 nationally determined contributions have set a conditional target of an overall 50pc reduction of emissions between 2015 and 2030 relative to the business-as-usual scenario, with a 15pc reduction using the country’s own resources and 35pc subject to international financial support.

Furthermore, quantitative targets are set for energy (by 2030, 60pc of all energy will be from renewable resources, including hydropower) and transport (by 2030, 30pc of all new vehicles sold will be electric vehicles).

The Ministry of Finance disclosed that the “government has also placed a moratorium on new coal plants and no generation of power through imported coal will be allowed”.

Similarly, Pakistan also announced the National Adaptation Plan in 2022, expected to be released later this year, for mainstreaming medium- and long-term climate change concerns into national policies, strategies and programmes.

It said the current fiscal year (2022-23) also saw significant external and domestic events, which impacted the economic outlook. Last year’s floods left a trail of widespread devastation, with losses to infrastructure, agriculture and livelihoods.

On the global front, the war in Ukraine disrupted supply chains and surged fuel prices, already high in a post-pandemic recovery phase. The resultant inflationary pressures and a high policy rate environment pushed the government’s borrowing costs to levels that were difficult to sustain. Trust deficit with major lenders added to the economic difficulties as external inflows remained below projections.

The finance ministry said increasing revenues over the medium term is critical to meet burgeoning expenditures and hence the government would optimise tax collection while maintaining business-friendly policies and ensuring taxpayers’ facilitation through the use of IT-based solutions that would also help broaden the tax net.

The finance minister has also flagged public-private partnership risks. It said the government had established the Public-Private Partnership Authority through an act of parliament under the Ministry of Planning and Development.

The authority has the mandate to regulate such transactions, helping federal implementing agencies in developing and procuring infrastructure projects through private sector investment and approving transactions that offer funding solutions to the public sector.

It is responsible for ensuring that “qualified projects” are aligned with national and sectoral strategies, conducting value-for-money analysis for qualified projects, appraising and assessing project risks, evaluating funding requirements, advising and supporting implementing agencies at all stages of the project cycle, standardising contractual provisions, developing sector-specific provisions and templates, analysing and assessing financial models, and collaborating with international agencies.

Published in Dawn, June 12th, 2023

Dear visitor, the comments section is undergoing an overhaul and will return soon.