PARIS: Multilateral development banks like the World Bank are expected to find $200 billion in extra firepower for low-income economies by taking on more risk, a move that may require wealthy nations to inject more cash, world leaders said on Friday.

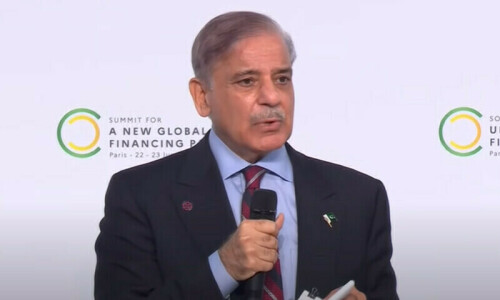

The leaders, gathered at a summit in Paris to thrash out funding for the climate transition and post-Covid debt burdens of poor countries, said their plans would secure billions of dollars of matching investment from the private sector.

An overdue pledge of $100bn in climate finance for developing nations was also now in sight, they said.

Many in attendance, however, said over the two-day summit that the World Bank and the International Monetary Fund were increasingly ill-suited for tackling the most pressing challenges and needed a broad revamp.

“We … expect an overall increase of $200bn of MDBs’ lending capacity over the next ten years by optimising their balance sheets and taking more risks,” the summit’s final statement obtained by Reuters said. “If these reforms are implemented, MDBs may need more capital,” it added, recognising in a final summit document for the first time that wealthy nations may have to inject more cash.

The final summit document called for each dollar of lending by development banks to be matched by at least one dollar of private finance, which analysts said should help international institutions to leverage an additional $100bn of private money in developing and emerging economies.

The announcements mark a scaling up of action from the development banks in the fight against climate change and set a direction for further change ahead of their annual meetings later in the year.

However, some climate activists were critical of the results.

“While the roadmap acknowledges the urgency for substantial financial resources to bolster climate action, it leans too heavily on private investments and ascribes an outsised role to multilateral development banks,” said Harjeet Singh, head of global political strategy at Climate Action Network International.

Debt relief

At the summit, the United States and China — long at odds on how to tackle debt restructurings for poor countries — sought to strike a more conciliatory tone after a landmark deal was reached on Thursday to restructure $6.3bn in debt owed by Zambia, most of it to China.

“As the world’s two largest economies, we have a responsibility to work together on global issues,” Yellen said on a summit panel shared with Chinese Premier Li Qiang among other leaders.

However, differences remain. China — the world’s largest bilateral creditor — has been pushing for lenders like the World Bank or the IMF to absorb some of the losses, which the institutions and Western countries oppose.

Climate pledge

The summit statement said there was a “good likelihood” of finalising this year a $100-billion climate finance pledge to developing countries.

Many of the topics discussed in Paris took up suggestions from a group of developing countries, led by Barbados Prime Minister Mia Mottley, dubbed the ‘Bridgetown Initiative’.

Published in Dawn, June 24th, 2023

Dear visitor, the comments section is undergoing an overhaul and will return soon.