KARACHI: Investors at the Pakistan Stock Exchange booked profits on Tuesday following a historic bull run a day ago.

Topline Securities said the stock market saw some buying in the early trading hours. However, investors opted to offload some of their positions, which led to the KSE-100 index losing some ground. In fact, profit-taking pulled the representative index down to the negative territory, it added.

Arif Habib Ltd said the stock market witnessed profit-selling after displaying the “best performance ever” in the preceding three trading sessions, which cumulatively pushed the benchmark up by 9.5 per cent.

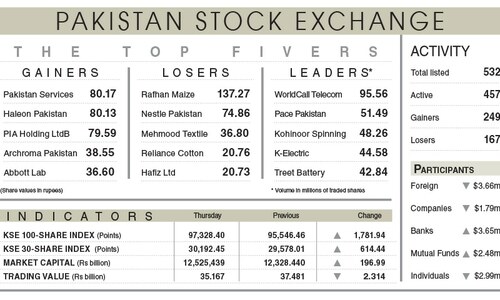

As a result, the KSE-100 index settled at 43,557.02 points, down 341.99 points or 0.78pc from the preceding session.

The overall trading volume increased 9.8pc to 419.3 million shares. The traded value went up 90.2pc to $57.5m on a day-on-day basis.

Stocks contributing significantly to the traded volume included Pakistan Refinery Ltd (44.2m shares), Cnergyico PK Ltd (42.4m shares), WorldCall Telecom Ltd (26.5m shares), Maple Leaf Cement Factory Ltd (20.9m shares) and Oil and Gas Development Company Ltd (18.3m shares).

Sectors contributing the most to the index performance were fertiliser (-160.7 points), cement (-76.4 points), chemical (-44.3 points), automobile assembling (-41.5 points) and commercial banking (-41.1 points).

Companies registering the biggest increases in their share prices in absolute terms were Sapphire Fibres Ltd (Rs39), Al-Abbas Sugar Mills Ltd (Rs32.78), Blessed Textiles Ltd (Rs23.38), Exide Pakistan Ltd (Rs18.83) and Khairpur Sugar Mills Ltd (Rs17.42).

Companies that recorded the biggest declines in their share prices in absolute terms were Nestle Pakistan Ltd (Rs150), Pakistan Tobacco Company Ltd (Rs39), Mari Petroleum Company Ltd (Rs35.17), Khyber Tobacco Company Ltd (Rs31.35) and Indus Motor Company Ltd (Rs25.22).

Foreign investors were net buyers as they purchased shares worth $3.46m.

Published in Dawn, July 5th, 2023

Dear visitor, the comments section is undergoing an overhaul and will return soon.