KARACHI: There’s growing uneasiness among big industrial groups about the zeal shown by the Public Accounts Committee (PAC) of the National Assembly in finding out the names of businesses that received subsidised loans of $3 billion under the Covid-era Temporary Economic Refinance Facility (TERF).

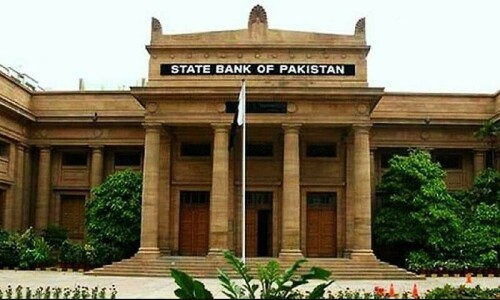

While spokespeople for large conglomerates have been sending out cryptic tweets that question the rationale of the move, the representative chamber of big capital has called TERF the “single most effective initiative” by the State Bank of Pakistan (SBP).

The SBP-backed facility allowed industrialists to borrow long-term loans from commercial banks for the import of machinery between April 2020 and March 2021 at a concessional interest rate. The TERF structure allowed the same commercial banks to recover the rest of the cost of funds from the SBP.

Members of the PAC have been demanding that the names of 628 beneficiaries of approved financing worth Rs435.7bn be disclosed given that they received “public funds”. After resisting the move for some time, the SBP has reportedly agreed to submit the names to the PAC in an in-camera session.

NA body is accused of ‘overreaching’ authority as information disclosure will breach confidentiality of banking data

But many analysts have questioned the legality of the move. As the SBP governor told the committee, disclosing the details of the TERF beneficiaries would be tantamount to breaching the confidentiality agreement between a bank and its client.

Speaking to Dawn, senior lawyer Basil Nabi Malik said the PAC is by law a “recommendatory body”. As such, the mandate of the PAC is “highly doubtful” when it demands the disclosure of sensitive banking information of private individuals, he said.

The accountability of private business groups is something beyond the domain of the PAC, he added. In addition, complying with the PAC directive may put the SBP in a difficult position, he said.

Section 53 of the SBP Act states that its officials must maintain secrecy with regard to the financial affairs of “any institution, person, body of persons, any government or authority whether in Pakistan or outside that may come to his knowledge in the performance of his duties”.

Economist Ammar H. Khan agrees with Mr Malik’s view about the limit of the PAC’s mandate. The PAC is “overreaching” its authority because TERF wasn’t financed by the taxpayers, he said. “You can’t find the TERF allocation in any budget document,” he noted.

Every loan involves two things — risk and liquidity. In TERF loans, commercial banks took on the risks while the SBP provided them with the liquidity for onward lending. That liquidity or cash originated from the SBP coffers, not the taxpayer’s pocket, he said.

Mr Khan said flaws in the policy design — such as no distinction between export and non-export businesses — doesn’t mean its beneficiaries should now be named, shamed and haunted for signing up for subsidised loans two years ago.

Data from subsequent years shows machinery imports went up, as did national exports. But subsidies to conglomerates often let governments pick winners and losers — something that creates distortions in the economy, says IBA Assistant Professor Dr Aadil Nakhoda.

Providing some businesses with heavy subsidies in the form of cheap financing and increasing taxes on other sectors like technology at the same time doesn’t promote investment on a long-term and sustainable basis, he said.

Published in Dawn, July 8th, 2023

Dear visitor, the comments section is undergoing an overhaul and will return soon.