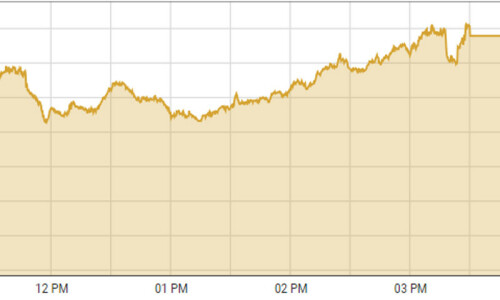

KARACHI: The benchmark index for the top 100 shares listed on the Pakistan Stock Exchange crossed the psychological barrier of 45,000 points on Tuesday, thanks to the ongoing bull run that commenced after the country signed up for a $3 billion Stand-By Arrangement with the International Monetary Fund during the Eid break.

Topline Securities said the upward trend began right after the opening bell and carried on until the end of trading hours. The rise was propelled by a rating upgrade from CCC- to CCC that Pakistan received a day ago from global agency Fitch.

The market also welcomed the earlier-than-expected arrival of Saudi funding of $2bn, which was announced by the finance minister during trading hours. The inflow also helped the rupee gain some ground lost a day ago against the greenback.

As a result, the KSE-100 index settled at 45,155.80 points, up 570.67 points or 1.28 per cent from the preceding session.

The overall trading volume increased 26.1pc to 555.1 million shares. The traded value went up 28.1pc to Rs15.4bn on a day-on-day basis.

Stocks contributing significantly to the traded volume included WorldCall Telecom Ltd (35m shares), Pakistan Refinery Ltd (31.4m shares), Fauji Foods Ltd (23.2m shares), TPL Properties Ltd (21.7m shares) and Cnergyico PK Ltd (21.6m shares).

Companies registering the biggest increases in their share prices in absolute terms were Rafhan Maize Products Company Ltd (Rs242.95), Khyber Textile Mills Ltd (Rs55.89), Nestle Pakistan Ltd (Rs55), Mehmood Textile Mills Ltd (Rs30) and Mari Petroleum Company Ltd (Rs29.82).

Companies that recorded the biggest declines in their share prices in absolute terms were Bata Pakistan Ltd (Rs38.35), Siemens Pakistan Engineering Ltd (Rs16.01), Dawood Lawrencepur Ltd (Rs15.70), Pakistan Services Ltd (Rs12.67) and Bhanero Textile Mills Ltd (Rs10).

Foreign investors were net buyers as they purchased shares worth $1.05m.

Published in Dawn, July 12th, 2023

Dear visitor, the comments section is undergoing an overhaul and will return soon.