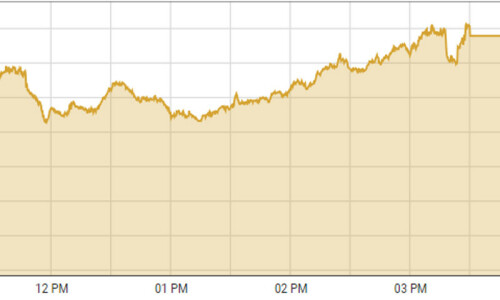

KARACHI: Equities underwent yet another bullish session on Wednesday with the benchmark index crossing the 45,500-point psychological barrier.

Topline Securities said the much-awaited vote at the board meeting of the International Monetary Fund (IMF) on Pakistan’s $3 billion bailout package helped improve sentiments. Investors opted for strengthening their equity positions by putting more money ahead of the crucial announcement, it said.

Another positive trigger was the reports about the actual and expected arrival of dollar deposits from two Gulf nations, which will help boost the country’s foreign exchange reserves.

Even though the overall momentum remains strong on the exchange, it’s starting to wane selectively with the market finding its equilibrium, according to Arif Habib Ltd.

It advised investors to “know what you want to buy” ahead of time in order to avoid hesitation when the index drops.

As a result, the KSE-100 index settled at 45,514.95 points, up 359.15 points or 0.8 per cent from the preceding session.

The overall trading volume decreased 18.8pc to 450.2 million shares. The traded value went down 15.1pc to Rs13.1bn on a day-on-day basis.

Stocks contributing significantly to the traded volume included WorldCall Telecom Ltd (49.9m shares), Unity Foods Ltd (20.3m shares), Pakistan International Bulk Terminal Ltd (18.2m shares), Pakistan Refinery Ltd (18.1m shares) and Aisha Steel Mills Ltd (17.1m shares).

Companies registering the biggest increases in their share prices in absolute terms were Rafhan Maize Products Company Ltd (Rs315.05), Colgate-Palmolive Pakistan Ltd (Rs73.78), Bata Pakistan Ltd (Rs35.34), Faisal Spinning Mills Ltd (Rs25.50) and Khyber Tobacco Company Ltd (Rs24.40).

Companies that recorded the biggest declines in their share prices in absolute terms were Unilever Pakistan Foods Ltd (Rs548.90), Reliance Cotton Spinning Mills Ltd (Rs37), Philip Morris Pakistan Ltd (Rs25.75), ZIL Ltd (Rs17.50) and Gadoon Textile Mills Ltd (Rs15.50).

Foreign investors were net buyers as they purchased shares worth $1.98m.

Published in Dawn, July 13th, 2023

Dear visitor, the comments section is undergoing an overhaul and will return soon.