KARACHI: Bulls defended the psychological level of 45,000 points for the second consecutive session on Wednesday as the benchmark index settled slightly above the preceding day’s close.

Topline Securities said investors remained cautious throughout trading hours as the KSE-100 index floated within a narrow band of 300 points following the release of the International Monetary Fund (IMF) Staff Report a day ago.

The report spelled out steps and guidelines for the country under the ongoing Stand-By Arrangement programme of $3 billion.

On the monetary policy front, the street view has tilted away from the status quo and towards a hike of 100 basis points post-IMF Staff Report, it said while referring to a recent survey that the brokerage conducted showing 52 per cent of participants expected a hike of 100 basis points or higher.

In contrast, Arif Habib Ltd said the State Bank of Pakistan was likely to hold the policy rate steady at 22pc in the meeting scheduled for July 31.

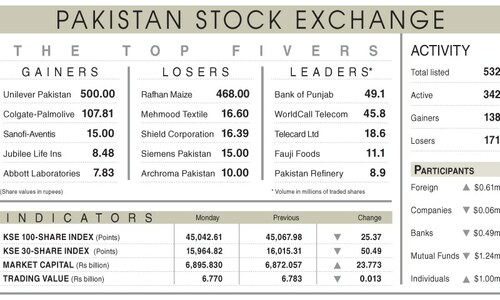

As a result, the KSE-100 index settled at 45,095.11 points, up 85.77 points or 0.19pc from the preceding session.

The overall trading volume decreased 3.7pc to 245.4 million shares. The traded value went up 28.4pc to Rs9.4bn on a day-on-day basis.

Stocks contributing significantly to the traded volume included WorldCall Telecom Ltd (18.5m shares), TPL Properties Ltd (10.3m shares), Pakistan Petroleum Ltd (8.9m shares), Waves Home Appliances Ltd (8.4m shares) and Pakistan Refinery Ltd (8.2m shares).

Companies registering the biggest increases in their share prices in absolute terms were Nestle Pakistan Ltd (Rs100), Khyber Textile Mills Ltd (Rs57), Siemens Pakistan Engineering Ltd (Rs24.01), Shell Pakistan Ltd (Rs8.35) and United Bank Ltd (Rs7.79).

Companies that recorded the biggest declines in their share prices in absolute terms were Colgate-Palmolive Pakistan Ltd (Rs121.49), Unilever Pakistan Foods Ltd (Rs50), Reliance Cotton Spinning Mills Ltd (Rs30), Lucky Core Industries Ltd (Rs14.97) and Highnoon Laboratories Ltd (Rs10.13).

Foreign investors were net buyers as they purchased shares worth $1.09m.

Published in Dawn, July 20th, 2023

Dear visitor, the comments section is undergoing an overhaul and will return soon.