KARACHI: The stock market extended its overnight losses on Friday to close on the lower side owing to a bad economic outlook.

Topline Securities said the index of representative shares opened on a positive note and went on to register an intraday high of 229 points. However, investors preferred to book some gains before the weekend by trimming their positions during the latter part of the day.

Arif Habib Ltd said the KSE-100 index temporarily dropped below the previous day’s low, but managed to hold its ground above the 48,000-point mark.

It said anticipation is building for potential positive triggers over the weekend, which can propel the index to surpass the 49,000-point level in the next week.

“Following a correction of around 1,000 points in the past two sessions, this decline could potentially be considered complete,” it added.

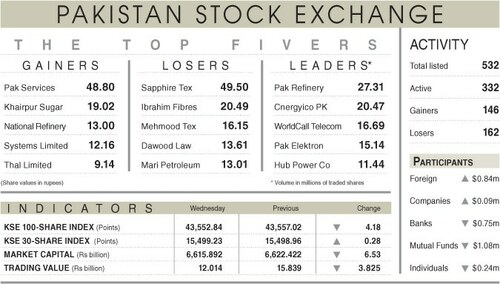

As a result, the KSE-100 index settled at 48,585.72 points, down 25.46 points or 0.05 per cent from the preceding session.

The overall trading volume decreased 37pc to 331.1 million shares. The traded value decreased 34.3pc to Rs12.5bn on a day-on-day basis.

Stocks contributing significantly to the traded volume included Cnergyico PK Ltd (66.5m shares), Oil and Gas Development Company Ltd (27.9m shares), Pakistan Refinery Ltd (25.8m shares), WorldCall Telecom Ltd (16.8m shares) and Hascol Petroleum Ltd (14.2m shares).

Companies registering the biggest increases in their share prices in absolute terms were Unilever Pakistan Foods Ltd (Rs150), Khyber Textile Mills Ltd (Rs60.57), Nestle Pakistan Ltd (Rs29.33), Blessed Textiles Ltd (Rs24.50) and Exide Pakistan Ltd (Rs21.87).

Companies that recorded the biggest declines in their share prices in absolute terms were Al-Abbas Sugar Mills Ltd (Rs37.90), Mari Petroleum Company Ltd (Rs19.16), JDW Sugar Mills Ltd (Rs16.75), Gadoon Textile Mills Ltd (Rs14.97) and JS Global Capital Ltd (Rs13.17).

Foreign investors were net buyers as they purchased shares worth $1.5m.

Published in Dawn, Aug 5th, 2023

Dear visitor, the comments section is undergoing an overhaul and will return soon.