The Pakistan Stock Exchange’s (PSX) benchmark KSE-100 index gained over 600 points on Friday, with experts attributing the surge to the addition of 15 Pakistan-listed companies to Morgan Stanley Capital International’s (MSCI) main Frontier Market index.

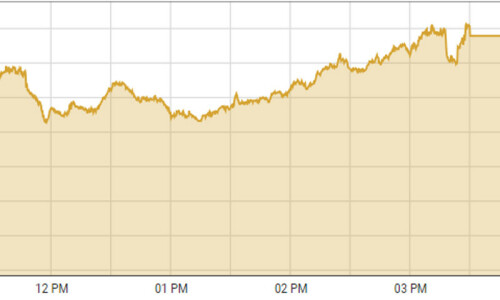

The benchmark KSE-100 index gained 616.06 points, or 1.29 per cent, to close at 48,424.40 points.

Speaking to Dawn.com, Salman Naqvi, head of research at Aba Ali Habib Securities, said the primary reason behind today’s surge was the addition of 15 Pakistan-listed firms to the MSCI FM index in a quarterly review yesterday.

“So, Pakistan’s weight, which was 0.6 per cent previously, has now increased to 2.6pc.

“This means that now there are a lot of Pakistani stocks available in the MSCI [FM] index to foreign investors for purchasing,” he explained.

Moreover, Naqvi continued, there were increments in the power sector as good dividends were expected to be announced along with good payouts.

“Apart from this, there is a signal of the IMF (International Monetary Fund) approving the dividend plug-in scheme related to the circular debt, which is why a tremendous increase can be seen in the Pakistan Petroleum, OGDC and PSO [shares].”

He further hoped that a good caretaker government would take over the reins of the country.

Meanwhile, Intermarket Securities’ Head of Equity Raza Jafri said the KSE-100 index had ended the week on a “buoyant note”.

“Fresh buying is being witnessed, with sentiments supported by Pakistan’s weight increase from 0.6pc to 2.7pc in the MSCI FM index. Banks in particular are seeing strong interest backed by their solid results and cheap valuations,” he added.