KARACHI: The four-day-long downward trend in the shares market saw a reversal on Thursday as the benchmark of representative stocks witnessed a turnaround on positive economic developments.

Topline Securities said investors’ sentiments remained buoyant throughout the day as they welcomed the initial virtual dialogue between the incumbent caretaker government and the International Monetary Fund with respect to the circular debt management plan.

Resultantly, blue-chip stocks in banking, technology and energy sectors received buying interest, it added.

Arif Habib Ltd said Faysal Bank Ltd, whose stock value dropped 6.96 per cent, disappointed the market with a dividend of Re1 per share. It said the benchmark level of 48,000 points will remain in focus in the Friday session.

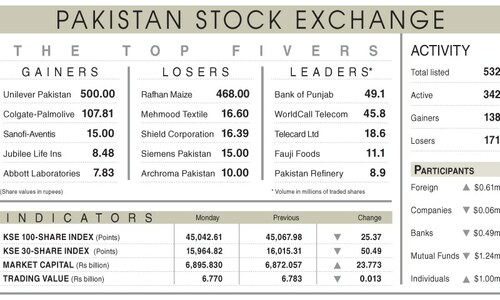

As a result, the KSE-100 index settled at 47,750.77 points, up 332.14 points or 0.7pc from the preceding session.

The overall trading volume increased 33.4pc to 251.7 million shares. The traded value increased 45.5pc to Rs12.8 billion on a day-on-day basis.

Stocks contributing significantly to the traded volume included Faysal Bank Ltd (21.9m shares), Nishat Chunian Power Ltd (15.2m shares), Gul Ahmed Textile Mills Ltd (14.6m shares), Oil and Gas Development Company Ltd (12.7m shares) and Fauji Cement Ltd (11.5m shares).

Companies registering the biggest increases in their share prices in absolute terms were Mari Petroleum Company Ltd (Rs18.86), Baluchistan Wheels Ltd (Rs11.17), Abbott Laboratories Ltd (Rs10.94), Indus Motor Company Ltd (Rs10.65) and Siemens Pakistan Engineering Ltd (Rs9.99).

Companies that recorded the biggest declines in their share prices in absolute terms were Nestle Pakistan Ltd (Rs102.17), Bata Pakistan Ltd (Rs9), AKD Hospitality Ltd (Rs5.77), Wah Noble Chemicals Ltd (Rs5.49) and Dawood Hercules Corporation Ltd (Rs4.63).

Foreign investors were net sellers as they offloaded shares worth $0.12m. major buyers were insurance companies that purchased shares valued $15.5m.

Published in Dawn, August 25th, 2023

Dear visitor, the comments section is undergoing an overhaul and will return soon.