KARACHI: The US dollar seems to hold complete sway over the exchange rate these days as banks, as well as forex companies, watch helplessly.

Currency experts said the dollar rates quoted by the banks and exchange companies are not real. The banks are reluctant to depict the real situation fearing the State Bank reaction, while the exchange companies don’t want to tell the truth fearing action taken against them, they added.

The State Bank on Tuesday reported the closing price of dollar at Rs303.05 in the interbank, while the Exchange Companies Association of Pakistan quoted the open market rate at Rs318.

Sources in banks said that with the opening of imports — a condition of the IMF — the banks feared that poor dollar inflows are not enough to meet the high demand from importers. Under this situation, the currency dealers in banks resist opening of letter of credits for imports.

British pound crosses 400 against rupee in open market

The banks are responsible for providing dollars for opening of L/Cs.

Bankers dismissed as rumours reports circulating in the financial circle that a huge amount of dollars would land in Pakistan next month and talks with the IMF are in a final stage.

The bankers said they don’t believe in such speculative reports and would continue to follow the ground reality which demands extreme cautious approach towards imports and the exchange rate.

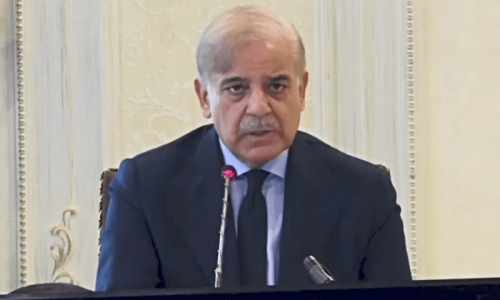

“With the induction of the interim government, the situation is going from bad to worse. Within 18 days of this government, the dollar appreciated by Rs14.40 to Rs303.05 from Rs288.65 on Aug 11 in the interbank,” said Atif Ahmed, a currency dealer in the interbank market.

The open market reported the dollar price at Rs318 on Tuesday, while it was Rs296 on Aug 11 — the day the interim government took charge.

The dollar appreciated by Rs22 per dollar since Aug 11.

However, a number of customers complained that exchange companies don’t provide dollars at the rate they announced. The price quoted by independent sources was in the range of Rs325-335 in the open market which was very close to the ‘grey market’ rate.

Along with the dollar, other major international currencies also appreciated significantly against the rupee during this period.

According to details provided by the exchange companies, the British pound was sold at Rs403 on Tuesday, while it was traded at Rs376 on Aug 11, an appreciation of Rs27 in 18 days.

Similarly, the euro appreciated by Rs21 to Rs345, while the Saudi riyal went up by Rs6.25 to Rs85.50 during the same period.

The inflows from these countries are huge in terms of remittances. The remittances in FY23 from Saudi Arabia were $6.5bn, followed by $4.056bn from the UK, $3.09bn from the US and $3.122bn from the European Union.

Only the riyal price is pegged with the US dollar, while other countries have their own value in the international market and all of them are appreciating against the rupee.

Published in Dawn, August 30th, 2023

Dear visitor, the comments section is undergoing an overhaul and will return soon.