KARACHI: Stocks suffered losses for the fourth straight session on Wednesday, driven by rumours about a steep hike in the interest rates, economic uncertainty and unrelenting rupee depreciation.

The market witnessed a sharp drop after rumours circulated that the State Bank of Pakistan is set to convene an emergency meeting in which it is expected to raise interest rates by up to 300bps, noted JS Global in its daily report.

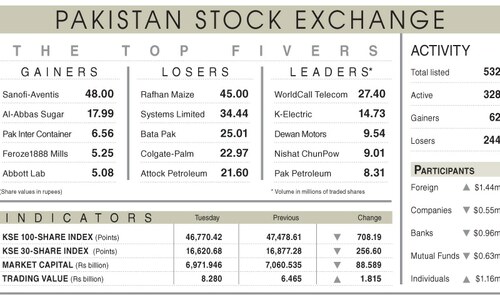

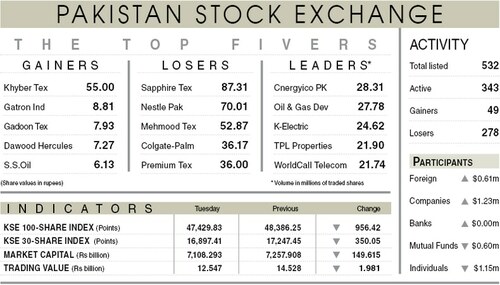

The benchmark KSE-100 shares index shed 525.86 points, or 1.12pc, closing at 46,244.56 points. The KSE-30 shares index dropped 199.93 points, or 1.20pc, at 16,420.76 points.

An analyst at Arif Habib Ltd explained that the bearish session was due to rupee depreciation and political upheaval.

“Inflation and an anticipated interest rate hike are among the reasons for the market decline,” he added.

The trading volume dipped to 200.28m shares from 217.85m shares the previous trading session.

Stocks contributing significantly to the trading volume included WorldCall Telecom (16.32m shares), K-Electric (12.42m shares), Dewan Motors (12.10m shares), Nishat Chunian (9.76m shares) and Pakistan Petroleum (7.88m shares).

Of the 327 active scrips, 70 advanced, 240 declined and 17 remained unchanged.

Companies registering the biggest increases in their share prices in absolute terms were Sapphire Fibre (Rs78), Sapphire Textile (Rs77.89), Bata Pakistan (Rs76.01), Lucky Core Industries (Rs7.55) and Murree Brewery (Rs6.30).

Sectors contributing negatively to the benchmark index included power generation and distribution (111.23 points), oil and gas exploration (90.40 points) and fertiliser (52.87 points).

Companies that recorded the biggest declines in their share prices in absolute terms Mehmood Textile (Rs54.50), Mari Petroleum (Rs20.92), Atlas Battery (Rs18.58), Abbott Laboratories(Rs18.48), and Shahmurad Sugar (Rs12.86).

Foreigners remained active buyers and picked shares worth $0.15m.

Published in Dawn, August 31st, 2023

Dear visitor, the comments section is undergoing an overhaul and will return soon.