Fuel prices crossed the psychological barrier of Rs300 per litre amidst the upward march of the US dollar against the rupee. New per litre prices of petrol and diesel, effective from September 1, are Rs305.36 and Rs311.84. Just a year ago, petrol and diesel prices stood at Rs233.91 and Rs244.44 per litre, respectively. So, within a year, petrol has become 30.5 per cent costlier and diesel 27.6pc.

After crossing Rs300 in the interbank market on August 24, the US dollar rose further up and closed at a new all-time high of Rs305.54 on August 31. Exactly a year ago, the dollar stood at Rs218.75 in the interbank market. So, the rupee has lost 39.7pc of its value against the mighty greenback.

These two factors, rising fuel prices and costlier foreign exchange continue to make it difficult for policymakers to provide impetus to economic growth and contain inflation. Consumer prices of electricity and gas also continue to rise rapidly. The entire country is protesting the latest increase in electricity prices. Traders and businessmen, backed by political parties, are resorting to shutter-down strikes.

All this is happening ahead of the next general elections. The caretaker government, whose prime responsibility is to hold fair and free elections, has promised some relief in electricity pricing for small consumers after seeking clearance from the International Monetary Fund (IMF), which remains stubbornly opposed to offering any new subsidies.

Further tightening interest rates will make businesses, already struggling with rising costs of production, even more uncomfortable, but the impetus of leaving it unchanged is too little to be of much help

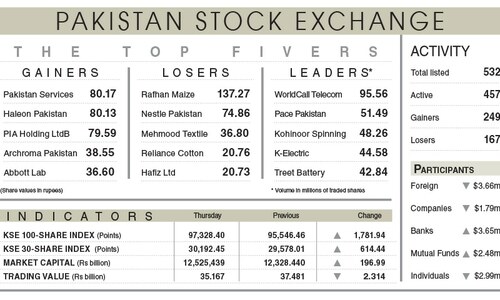

The political temperature is heating up ahead of elections, and growing uncertainty is taking its toll on forex and stock markets. In August, the stock market fell by 6.3pc — its highest monthly decline since March 2020 when Covid-19 hit the country.

Higher fuel and energy prices and depreciating rupee value continue to fuel inflation. National average consumer inflation readings for August are yet to be published. But during the week ended on August 24, inflation based on the sensitive price index rose 25.3pc year-on-year, according to the Pakistan Bureau of Statistics. The situation is very painful, particularly for the people who fall into low-income groups.

Fuel prices may continue to rise further, given that international oil prices are on the rise, and Pakistan has promised the IMF to continue to charge Petroleum Development levy on petrol and diesel. The caretaker government cannot address the root cause of unusually high fuel and energy prices because it is not here to stay: its job is to hold elections and transfer powers to the new, elected government.

Even the newly elected government will find it next to impossible to address structural issues surrounding higher fuel and energy prices —the expansion in circular debt in the energy sector. The circular debt keeps expanding year after year primarily because of the imprudent agreements Pakistan had signed with the independent power producers back in the 1990s.

It also keeps expanding as energy distribution companies fail to collect power bills from some segments of the population, and they also fail to contain line losses and pilferage/theft of electricity and gas.

Higher fuel and energy prices and falling rupee continue to add to the cost of production across the entire spectrum of economic activity. Amidst this environment, managing inflation and exchange rates is becoming increasingly difficult.

If the State Bank of Pakistan goes for further tightening of interest rates, that will make businesses, already struggling with their rising cost of production, even more uncomfortable. And if it leaves the rates unchanged, expecting that the move will make it a bit easier for industries to produce more, this impetus would be too little.

Besides, it is not enough to encourage industries to produce more for domestic consumption; providing them with an export-friendly environment is also necessary to put falling export earnings (down 8.1pc year on year in July) back on a growth trajectory.

That is too difficult given the fact that not only the cost of industrial inputs has been on the rise, but on the IMF’s insistence, the SBP has started withdrawing interest rates subsidies from the export sector.

Only the best and the already most competitive export houses can now survive. But will their combined forex earnings be enough to boost the overall exports of the country? That depends on how fast the government and the private sector can jointly work on a strategy to align Pakistan’s export sector with the growing regional supply chain.

That also depends on how both can work together to introduce innovative and high-end value-added products in the export basket.

After the establishment of the civil-military controlled Special Investment Facilitation Council, people are expecting quicker inflows of foreign direct investment into the country. That depends on whether Pakistan allows foreign investors, particularly those from the Gulf Cooperation Council countries, to invest in non-conventional areas of investment, including aviation, defence production, education, e-governance, tourism and recreation etc.

Home remittances, the second largest source of foreign exchange, can be enhanced by cracking down more effectively on Hundi/Havala operators. There is also a pressing need to rethink the policy of allowing Afghan traders to settle trade with the foreign exchange purchased from Pakistan’s open market.

Furthermore, the entire labour export policy needs to be revisited with the objective of (1) exploring new markets while retaining the GCC market, (2) gradually increasing the share of skilled workers and professionals in the overall occupational mix of labour export, and (3) encouraging more female workers to find and retain foreign jobs.

In 2020, 225,113 Pakistanis had left the country for overseas jobs. Of them, only 1,725 or only about 0.8pc, were women. Gender-wise breakup of labour exports of 2021 (288,280 people) and 2022 (832,339 people) are not available yet. Can any developing country relying heavily on remittances afford to let this important source of foreign exchange remain solely in the hands of men?

Published in Dawn, The Business and Finance Weekly, September 4th, 2023

Dear visitor, the comments section is undergoing an overhaul and will return soon.