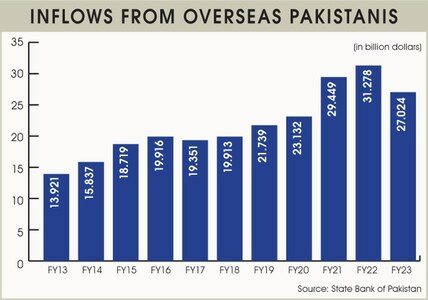

KARACHI: Remittances sent by overseas Pakistanis slightly increased by 3 per cent month-on-month in August while it tumbled by over 23pc year-on-year. However, the inflow of remittances during the first two months of the current fiscal year also fell by 21.6 per cent. The data released by the State Bank of Pakistan (SBP) on Monday showed that the remittances totalled $2.092bn in August compared to $2.029bn in July.

The previous fiscal year proved worst for the country as the remittances fell by $4.2bn at the time when the country was on the brink of sovereign default. The remittances kept falling in FY23 and the trend did not change.

In August 2022, the remittances were $2.744bn. Currency experts said the trend may persist for the first half of the current fiscal year due to prevailing political and economic uncertainties.

During July-August FY24, the remittances were $4.121bn compared to $5.255bn in the same period of the previous fiscal year, a decline of 21.6pc.

Further details show that the inflows from most of the destinations declined except for EU countries. The remittances from Saudi Arabia fell 23pc to $977m during July-August compared to $1.26bn during the same period of last year.

The remittances from the UK and the US declined by 18pc and 7.6pc to $638m and $503.7m, respectively.

The remittances from the UAE fell by 37.4pc to $623.5m compared to $996.3m in the same period of last year. The UAE has been the second biggest destination for remittances after Saudi Arabia. The big decline should be highly concerning for the economic managers. The inflows from Gulf Cooperation Council countries (minus Saudi Arabia and UAE) fell by 18.8pc to $472.8m during the two months.

However, the inflows from the EU countries remained intact and the remittances during the two months were unchanged at $573m.

The outflows of skilled and unskilled labour from Pakistan during the last one and half years could not bring any change in the inflows. It is widely believed the grey market is still attracting remittances to due to much higher prices causing losses to the country.

Published in Dawn, September 12th, 2023