ISLAMABAD: Speakers at the launch of a research study on the economy stressed that Pakistan needed to address the foundational economic issues rather than resorting to short-term solutions to fix the structural and inherent fault lines of the economy.

“Pakistan is labelled as a UN debt-stressed country, ranked 3rd among 40 such countries and a major chunk of its budget goes towards debt servicing, said Board of Investment Chairman Haroon Sharif at the launch ‘Rethinking Pakistan’s Economy: Putting the House in Order’ report published by the Center for Research and Security Studies (CRSS).

He said Pakistan’s GDP to investment ratio has not improved and its reliance on short-term, high-interest loans perpetuated the economic crisis. “Economic problems have been historically viewed and resolved through a geopolitical lens. This is now changing. A silver lining is that reaching this stage might drive a more genuine effort to address economic issues without the influence of geopolitics,” he said.

According to a statement, Mr Sharif, a former World Bank official, emphasised the need for value-adding investments and a shift towards a knowledge-based economy. He also highlighted the ‘importance’ of higher profit margins and stopping economic leakages and recommended shifting the focus from “selling mere dreams to creating actual value”.

Expert says Pakistan does not have conducive environment to attract investments

Prof Dr Aliya Hashmi Khan, former dean of the faculty of social sciences at Quaid-i-Azam University, brought attention to gender budgeting as an issue that has not caught attention in Pakistan.

“Gender disparities have been identified in the country by various monitoring bodies dedicated to gender parity. Addressing these gaps does not require going out of the conventional ways,” she said.

She stated the country did not have a conducive environment to attract investments and lacked the soft infrastructure as well needed for the success of economic zones like CPEC.

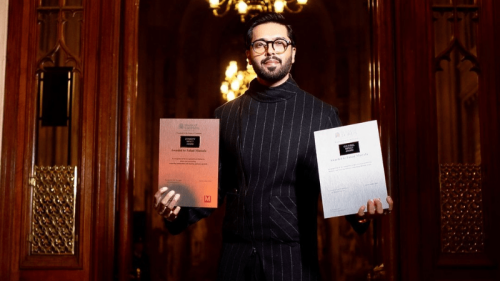

Saddam Hussein, the lead author of the research report enunciated that Pakistan’s enduring struggle with economic and political instability has left it entangled in the perplexing enigma of unstable development.

“Since its inception, the economic performance of Pakistan has been marred by extreme volatility. This tells a lot about the character of our will and strategic planning. In a one-liner, it can be said that it has all been just firefighting and the absence of long-term vision,” he said.

The report published by CRSS depicted insights into Pakistan’s economic fault lines and the options for revival. It noted that it was imperative for Pakistan to focus on the IT and agriculture sectors in the short run, as the outcomes could be reaped within a season. Afterwards, the medium-term approach should promote industrialisation, particularly in the export sector, to have a sustainable source of foreign exchange earnings.

Published in Dawn, September 17th, 2023

Dear visitor, the comments section is undergoing an overhaul and will return soon.