KARACHI: Market sentiments remained predominantly positive in the outgoing week.

Arif Habib Ltd said the mood was bolstered by significant developments on economic and political fronts. The Election Commission of Pakistan announced the general election would be held in the last week of January 2024. The announcement helped address uncertainty in the market.

Moreover, the cut-off yield in the latest auction of treasury bills declined by as much as 217 basis points. In addition to this, the rupee exhibited consistent appreciation over the week. The local currency closed against the dollar at 291.76 after gaining 5.1 or 1.7 per cent week-on-week.

Moreover, foreign exchange reserves of the central bank increased by $56 million to reach $7.7 billion.

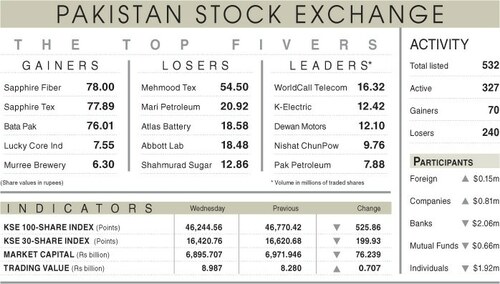

As a result, the benchmark index of the stock market closed at 46,421 points after increasing by 668 points or 1.5pc from a week ago.

Sector-wise, positive contributions came from commercial banking (202 points), power generation and distribution (111 points), oil and gas exploration (96 points), chemical (77 points) and pharmaceutical (31 points) sectors.

Sectors that contributed negatively to the index were technology and communication (14 points) and fertiliser (seven points).

Scrip-wise, positive contributors were United Bank Ltd (106 points), the Hub Power Company Ltd (103 points), Colgate-Palmolive Pakistan Ltd (59 points), MCB Bank Ltd (49 points) and Pakistan Petroleum Ltd (35 points).

Negative contributions came from Systems Ltd (28 points), Engro Corporation Ltd (20 points), Unilever Pakistan Foods Ltd (10 points), Cherat Cement Company Ltd (nine points) and Bank Alfalah Ltd (nine points).

Foreign buying clocked in at $0.29m versus a net sale of $9.67m a week ago. Major buying was in commercial banks ($1.69m) and technology and communication ($1.3m). On the local front, selling was reported by insurance companies ($1.35m) and banks ($1.21m).

According to AKD Securities, the stock market’s trajectory is expected to be driven by inflation readings in the coming few months in addition to further clarity on the upcoming review by the International Monetary Fund.

In the near term, appreciating currency and the expectation of higher remittances in September are keeping investors optimistic, it added.

Published in Dawn, September 24rd, 2023

Dear visitor, the comments section is undergoing an overhaul and will return soon.