KARACHI: The Pakistan Stock Exchange (PSX) exhibited on Wednesday a sideways trading pattern for the third consecutive day before closing the session on a slightly higher note.

Topline Securities said investors kept waiting for a clear market direction owing to the absence of any significant catalysts.

According to Arif Habib Ltd, the KSE-100 index recorded marginal gains, further cementing its position above the 46,000-point level.

Blue-chip names like Oil and Gas Development Company Ltd, Pakistan Petroleum Ltd, Fauji Fertliser Company Ltd and Pakistan State Oil Company Ltd performed well. Meanwhile, the rupee continued gaining strength for the 16th straight session and hit 288.70 versus the dollar. It’s up 6.4 per cent from its recent low.

The brokerage added that it’s looking forward to the upside expansion in Thursday’s session, causing a strong close to the ongoing week.

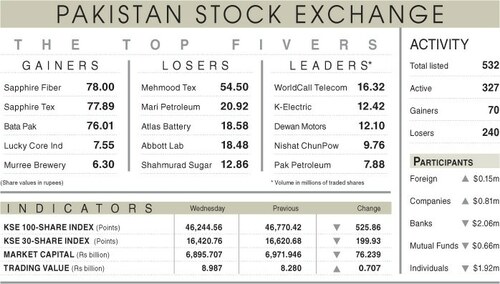

As a result, the KSE-100 index settled at 46,365.04 points, up 87.38 points or 0.19pc from the preceding session.

The overall trading volume decreased 31.5pc to 177.5 million shares. The traded value increased 3.6pc to Rs6.9bn on a day-on-day basis.

Stocks contributing significantly to the traded volume included Maple Leaf Cement Factory Ltd (11m shares), Pakistan Petroleum Ltd (9.1m shares), WorldCall Telecom Ltd (7m shares), Pakistan International Airlines Corporation Ltd (6.9m shares) and Oil and Gas Development Company Ltd (6.8m shares).

Companies registering the biggest increases in their share prices in absolute terms were Unilever Pakistan Foods Ltd (Rs450), Pakistan Hotels Developers Ltd (Rs15.45), Mehmood Textile Mills Ltd (Rs14.50), Mari Petroleum Company Ltd (Rs9.73) and Bhanero Textile Mills Ltd (Rs9).

Companies that recorded the biggest declines in their share prices in absolute terms were Nestle Pakistan Ltd (Rs47.21), Pakistan Services Ltd (Rs29.85), Premium Textile Mills Ltd (Rs25.23), Systems Ltd (Rs7.74) and Khyber Tobacco Company Ltd (Rs5.20).

Foreign investors were net sellers as they offloaded shares worth $0.34m.

Published in Dawn, September 28th, 2023

Dear visitor, the comments section is undergoing an overhaul and will return soon.