The caretaker government’s decision to divest 25 per cent of the federal government’s stake in a promising mining project has triggered apprehensions within Pakistan’s mining circles. While not overtly opposing this decision, many individuals have raised doubts about its wisdom.

“Who makes such a move? Even with a 50/50 partnership alongside Canadian mining giant Barrick Gold Corporation, Pakistan was already in a relatively weaker position to safeguard its interests due to its limited capacity and expertise in managing business affairs.

Now, by relinquishing a significant portion of its stake, one can’t help but wonder what the future holds for the country and its citizens, who rightfully expect to benefit from their own land’s wealth,“ said an observer who chose not to be quoted due to need for formal permission from his employer before going public.

Pakistan’s 50pc share in the joint venture project is evenly split between the federal and Balochistan governments. The ongoing debate revolves around the divestment of the federal government’s 25pc share, while the Balochistan share has not been touched.

“Why tamper with an agreement that was painstakingly negotiated? Pakistan has faithfully fulfilled its part of the deal by committing $900 million to the project despite financial strains. If Barrick Gold has any reservations, they should be addressed within the parameters of the signed agreement. We cannot afford to revisit such intricate deals on whims; it would not serve our purpose. If the investor has become hesitant, this is not the right approach to resolving the situation,” commented a technocrat with privileged access to insider information.

Riyadh’s involvement would serve as a safeguard against hasty decisions by the government for Barrick Gold but dilute Pakistan’s interests

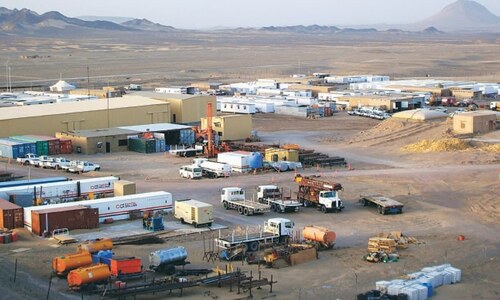

Characterising the engagement of a significant Arab nation in the Reko Diq project as ‘extremely sensitive’, key officials, experts and executives of state-owned enterprises (SOEs) were reluctant to formally express their views on the Pakistan government’s proposal to diminish its stake in the multi-billion-dollar copper and gold mining project. This strategic manoeuvre is intended to open opportunities for foreign investors and promote foreign direct investment in Pakistan.

Recently, the joint civil and military apex body, the Special Investment Facilitation Council (SIFC), revealed its intentions to attract Saudi investors by accommodating their interest in participating in the Reko Diq project. The SIFC press release emphasised that if materialised, the new partnership in the mining sector could open the door for much-needed investments from our oil-rich brotherly nation.

It was reported that SIFC has decided to sell 25pc of the federal government’s shares held by three state-owned entities — Oil and Gas Development Corporation Limited (OGDCL), Pakistan Petroleum Limited (PPL) and Government Holdings Pakistan Limited (GHPL). On the SIFC directives, the relevant SOEs have started engaging with Saudi investors. Two of the three listed SOEs, PPL and OGDCL, have informed the Pakistan Stock Exchange about their intent.

Messages requesting input were sent to the phones of Ahmed Hayat Lak, MD, OGDCL, Masood Nabi, MD and CEO, GHPL and Imran Abbasy, MD, PPL. Mr Abbasy was the only one who responded, calling from Abu Dhabi. He assured that he would provide an update upon his return. The two other executives did not respond to the query.

A corporate lawyer knowledgeable about the foreign company’s affairs shared insight into Barrick’s desires and discussions within official circles. He stated, “Saudi involvement would serve as a safeguard against hasty or illegal decisions by the Pakistan government, given the imperative not to strain relations with Saudi Arabia for obvious reasons.”

“Initially, the government sought to sell half of its shares to Saudi investors and expected that Barrick would divest half of its stakes as well, but Barrick declined the proposal.”

Regarding the proposed deal’s merit, he remarked, “I think the government is making a mistake by selling all of its shares to Saudis. How can the price be determined without competition? This could potentially lead to a huge scandal in the future.”

Repeated attempts to obtain comments from SIFC and Barrick Gold regarding recent developments were unsuccessful. People associated with or invested in the lucrative Reko Diq project appeared not only reluctant but also apprehensive about sharing their views in writing or over the phone.

“Foreign investment is vital for capital-intensive, technologically advanced mining projects in remote regions of the country, but it should not come at the expense of the people’s rights to mineral wealth,” commented an expert on overseas investment.

A member of the caretaker’s top team shared his perspective on condition of anonymity. “I firmly believe that Pakistan needs strategic investment from Saudi Arabia to make them stakeholders in Pakistan’s progress,” he stated.

The Caretaker Finance Minister, Dr Shamshad Akhtar, was approached for comments, but her response was not received within the deadline.

Domestic mining sector sources, lobbying for a share in the biggest mining project in the country, have closely been observing the process every step of the way. They said the Canadian investors were also keen to replace the government of Pakistan with a Saudi company to cut down the risks associated with a huge investment of exclusively Western country in restive Balochistan.

“Barrick and Ma’aden have a history of working together. They have also partnered in a copper and gold project at Jebel Ali in Saudi Arabia. It is not surprising that they are mutually comfortable and keen to extend their business relationship to Pakistan,” a mining company’s executive noted.

“Besides, by having Ma’aden as part of the joint venture, Barrick hopes to have more leverage with the government as

the country counts Saudis as a dependable ally and would be ready to bend backwards to accommodate them,“ he added. He did not favour expanding overseas investors’ stakes beyond 50pc in the said project.

Published in Dawn, The Business and Finance Weekly, October 9th, 2023

Dear visitor, the comments section is undergoing an overhaul and will return soon.