KARACHI: Profit-takers held sway over the stock market on Wednesday as investors chose to cash in their earlier gains.

Topline Securities Ltd said banking, auto and IT stocks performed well while some energy heavyweights put a dent to the index of the representative shares listed on the national bourse.

Furthermore, the rupee experienced a second day of depreciation against the dollar before settling at 280.29.

Arif Habib Ltd said selling pressure in the stock market follows the 50,000-point test a day ago. The KSE-100 index has declined approximately 600 points from the preceding day’s high, the brokerage said, adding that the 48,500-point level can be seen in the near term.

“Going forward, investors are likely to closely observe the geopolitical situation and any news of de-escalation of tension would be taken as positive for the market,” said JS Global Capital Ltd.

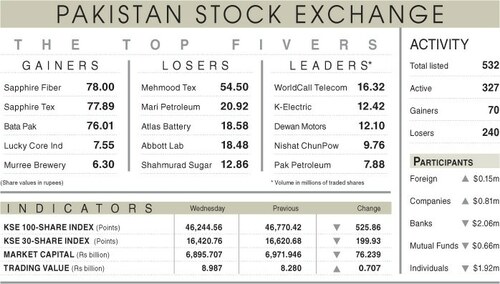

As a result, the KSE-100 index settled at 49,431.48 points, down 99.53 points or 0.2pc from the preceding session.

The overall trading volume decreased 9.7pc to 332.6 million shares. The traded value decreased 15.2pc on a day-on-day basis to Rs8.8 billion.

Stocks contributing significantly to the traded volume included Pakistan Refinery Ltd (75.7m shares), K-Electric Ltd (37.4m shares), Pakistan International Bulk Terminal Ltd (23.6m shares), WorldCall Telecom Ltd (14.9m shares) and Cnergyico PK Ltd (13.7m shares).

Companies registering the biggest increases in their share prices in absolute terms were Bhanero Textile Mills Ltd (Rs36.50), Premium Textile Mills Ltd (Rs26.85), Khairpur Sugar Mills Ltd (Rs24.94), Faisal Spinning Mills Ltd (Rs21.50) and Hinopak Motors Ltd (Rs18.46).

Companies that recorded the biggest declines in their share prices in absolute terms were Mehmood Textile Mills Ltd (Rs37.50), Nestle Pakistan Ltd (Rs12.41), the Premier Sugar Mills Ltd (Rs10.55), Tri-Pack Films Ltd (Rs10.42) and Al-Abbas Sugar Mills Ltd (Rs10).

Foreign investors were net buyers as they purchased shares worth $0.64m.

Published in Dawn, October 19th, 2023