Pakistan’s economic growth has been persistently hampered by its current account deficit (CAD), a situation where the country’s imports exceed its exports, resulting in a shortage of foreign currency. This deficit has been escalating over several decades, posing significant challenges to Pakistan’s economic stability.

The CAD issue is exacerbated by Pakistan’s dependence on international financial institutions and foreign markets to finance its deficits, as the country lacks substantial sovereign resources. These CAD episodes become more frequent and severe as time progresses, raising concerns about the nation’s economic future.

The Current Account (CA) is a crucial component of a country’s Balance of Payments (BoP) account, recording transactions related to goods and services, primary income, and secondary income in international interactions. Pakistan’s CA has not aligned with its trading partners’ accounts, creating a structural imbalance. When imports exceed exports, a CAD emerges, necessitating external borrowing to cover the deficit.

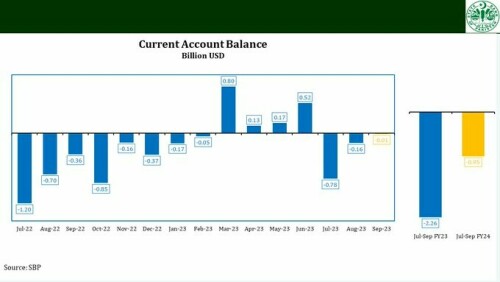

Before the 2000s, Pakistan’s CAD typically remained below five per cent of its GDP, averaging around 2pc in the 1980s and 1990s. However, after 2000, the CAD ballooned, reaching its highest levels in FY08 and FY18, at approximately $14 billion and $18bn, respectively.

Deindustrialisation has contributed to export stagnation, causing Pakistan’s share of international exports to drop since the early 1990s, reaching only 0.13pc in 2020

Analysing the components of the CAD, it’s evident that net secondary income inflows have seen a steady increase, from around $5bn billion in FY01 to over $32bn in FY21, primarily due to remittances from Pakistanis working abroad.

On the other hand, the trade deficit has been fluctuating, indicating problems with both imports and exports of goods and services. This deficit grew from approximately $5bn in FY01 to $45bn in FY21, suggesting a significant increase in the value of goods and services imported compared to those exported.

Pakistan’s exports, which peaked at around 15pc of GDP in 2003, have been on a downward trajectory since 2011, currently accounting for about 11pc of GDP. This percentage is considerably lower than that of similar economies. Deindustrialisation has contributed to this export stagnation, causing Pakistan’s share of international exports to drop by around 40pc since the early 1990s, reaching only 0.13pc in 2020.

The main exports from Pakistan include textiles and apparel, agricultural products, and services, which have seen a slight increase in value over the past few decades. However, these exports are mostly primary or low-tech goods that require minimal technology for production, making it difficult to move up the value chain.

Moreover, the volume of differentiated goods exported has declined. In contrast, other economies like Sri Lanka and Vietnam have increased both the volume and quality of their exports.

China, the USA, Afghanistan, the UK, the European Union, and the UAE are Pakistan’s top export markets. According to an International Monetary Fund report, the majority of these market shares are either static or shrinking. Furthermore, Pakistan’s export variety is minimal compared to its global counterparts, with persistent declines and stagnant export quality.

The import value has risen significantly, even when the volume remains relatively stable. While currency depreciation plays a role in making the same volume of imports more expensive, other factors contribute to the increased import value.

Furthermore, Pakistan heavily depends on imports for its energy needs, constituting about 20pc of its total import bill. Fluctuations in global oil prices significantly impact Pakistan’s CAD. Import composition is crucial, too, with consumer imports rising sharply while capital imports have seen limited growth. This correlation between increased consumer imports and CAD is evident.

When comparing Pakistan to emerging markets and developing economies (EMDEs), it appears that Pakistan is relatively closed in terms of trade openness, with restrictive trade policies in place since the 1990s. The country is ranked as the seventh most protected economy globally, with high tariff rates and a complex tariff structure. Import tariffs contribute significantly to the country’s total tax revenues.

These high tariffs harm local firms by compromising their export competitiveness and resource allocation efficiency. Pakistan’s tariff structure is the most complex among South Asian countries, with multiple discretionary tariff rates and regulatory duties that raise the effective rate of protection for domestic producers.

This situation leads to an increase in production costs, causing producers to target domestic markets instead of international ones. Pakistan’s trade policy also includes an exemption culture in customs duties. Large firms with significant export volumes receive more exemptions, allowing them to create value additions. In contrast, small firms struggle to break out of this cycle due to their low export volumes.

While a depreciating exchange rate theoretically should benefit a country’s exports by making domestic products cheaper for foreign buyers, Pakistan has been unable to fully capitalise on this opportunity.

Several institutional and economic factors hinder its ability to leverage a depreciating currency for export growth. Historically, exchange rate depreciation has had a substantial impact on trade volume in developed and EMDEs.

However, Pakistan’s ability to benefit from such depreciation is limited due to factors like global economic slowdown, structural constraints, limited export experience, and volatile conditions that affect smaller and potential exporters.

Trade agreements are another avenue for boosting exports, but Pakistan has not maximised their potential. Overvalued exchange rates, poorly structured tariffs, and inadequate negotiation strategies have limited the effectiveness of these agreements. A significant portion of Pakistan’s exports goes to countries with which it has not signed free trade agreements, further complicating its trade landscape.

In summary, Pakistan faces numerous economic challenges, with the growing CAD being a significant concern. Structural reforms, improved trade policies, and enhanced export competitiveness are essential to address these issues and promote long-term economic growth and stability in the country.

The writer is an assistant professor and a researcher at the Centre of Economic Planning and Development, Minhaj University Lahore

Published in Dawn, The Business and Finance Weekly, October 23rd, 2023

Dear visitor, the comments section is undergoing an overhaul and will return soon.