KARACHI: The benchmark of equities moved within a narrow range on Thursday even though the session began on a positive note, thanks to the bullish momentum that investors carried forward from a day ago.

Topline Securities Ltd said the market witnessed profit-taking in the second half of the session, compelling the KSE-100 index to shed the gains it’d made in the early trading hours.

Stocks in the banking sector remained star performers because of some outstanding financial results and dividend announcements exceeding street expectations.

Arif Habib Corporation Ltd analyst Ahsan Mehanti said stocks closed flat amid uncertainty over the rupee’s fate after US firm Goldman Sachs called the currency’s recovery short-lived.

However, expectations about the inflow of $700 million from the International Monetary Fund next month played the role of a catalyst in the positive close.

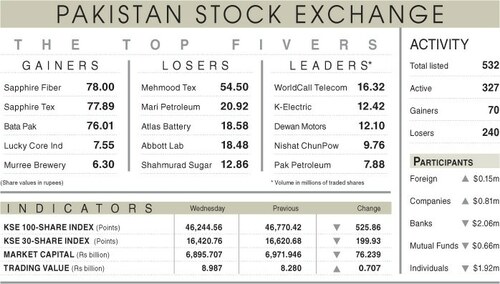

As a result, the KSE-100 index closed at 51,185.28 points after gaining 8.15 points or 0.02 per cent from the preceding session.

The overall trading volume decreased 14.8pc to 364 million shares. The traded value decreased 29.5pc to Rs10.9bn on a day-on-day basis.

Stocks contributing significantly to the traded volume included Pakistan WorldCall Telecom Ltd (57.4m shares), the Bank of Punjab Ltd (46.1m shares), K-Electric Ltd (20.8m shares), HBL Investment Fund Ltd (13.2m shares) and Dewan Cement Ltd (11.1m shares).

Companies registering the biggest increases in their share prices in absolute terms were Service Industries Ltd (Rs28.74), Al-Ghazi Tractors Ltd (Rs23.56), Pakistan Tobacco Company Ltd (Rs21.71), Pak Suzuki Motor Company Ltd (Rs20.63) and Philip Morris Pakistan Ltd (Rs18.58).

Companies registering the biggest declines in their share prices in absolute terms were Sapphire Fibres Ltd (Rs88.44), Faisal Spinning Mills Ltd (Rs20), Sitara Chemical Industries Ltd (Rs12.71), Indus Motor Company Ltd (Rs8.76) and Mari Petroleum Company Ltd (Rs8.62).

Foreign investors were net buyers as they purchased shares worth $0.33m.

Published in Dawn, October 27th, 2023

Dear visitor, the comments section is undergoing an overhaul and will return soon.